Surface plate m 11 for inner only

Let's consider in more detail step by step instructions on filling out the invoice requirement in 1C 8.3 (Accounting).

Write-off of own materials

Today we will dwell in more detail on how to fill out the "Requirement-waybill" in 1C, as they continue to ask questions about it.

So what does this document and where is it located in the 1C program? He writes off the materials necessary for the production of finished products from the warehouse and transfers, accordingly, to production. More precisely, this will already be considered production costs. As a rule, this is the debit of account 20.01 "Main production".

Account 20.01 is not quantitative, only summative. Therefore, it accumulates all production costs: both material (direct) and indirect (costs of electricity, heating, workers' wages, etc.).

Document 1C 8.3 "Requirement-waybill" in production can only write off raw materials. this document cannot be written off.

The cost account is indicated in the column of the same name "Cost account" in each row of the table. If you cancel the mode of specifying cost accounts in the tab with materials, the “Cost account” tab will become visible, and the column will disappear. On this tab, you enter a cost account once and all materials are written off to it. This is convenient if all materials are debited to one account.

To create and fill out a document, you need to go to the "Production" menu and click on the "Requirement-invoice" link in the "Production release" section. After that, we will get into a window with a list of already created documents (if any). Press the button "Create". A window for creating a new document will open.

Be sure to fill in the details:

Get 267 1C video tutorials for free:

- Organization (if the program keeps records for several).

- The warehouse from which the write-off will take place.

A sample of filling out a bill of lading in 1C 8.3:

In order for the document to form transactions and thereby be reflected in the accounting, press the "Post" button.

Now you can see the transactions that were formed when posting the document. Let me remind you that for this you need to press a button:

It can be seen from the figure that the cost account (20th) has analytics, or rather three sub-accounts: "Subdivision" - we have it "Fixtures", "Nomenclature group" - in in this case "Main group" and directly the name of "Cost items" - for example, "Material costs".

Analytics can be useful in reports to analyze a particular subconto.

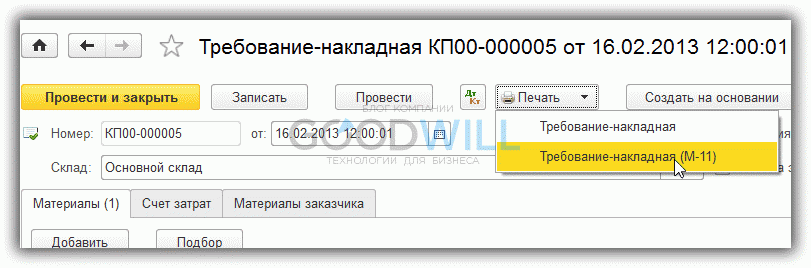

Printing of the M-11 form from 1C 8.3

The program has the ability to print a special form M-11. You can print it by pressing the button "Print - Requirement-Invoice (M-11)":

In addition to the regulated form, the system also has a simplified, "managerial" printing form - it is the first in the list.

What is the M-11 invoice requirement? In the article, we will consider why a document is needed, on the basis of which it is drawn up, how it is drawn up, how much is stored. All of the sample forms mentioned in the article can be downloaded.

A bill of lading (form M-11) is an internal document of the organization - it is not transferred to either the buyer or the supplier. All movements of materials in the organization: between departments, from employee to employee - are accompanied by the execution of this document.

The unified forms of primary accounting documents approved by the Resolution of the State Statistics Committee of October 30, 1997 No. 71a are not mandatory, based on the requirements of Law No. 402-FZ. The organization can fix the forms of primary accounting documents in the accounting policy. The exception is unified forms that are mandatory for use on the basis of federal laws and regulations.

Unified forms for public sector organizations are defined in the order of the Ministry of Finance dated March 30, 2015 No. 52n, which specifies the invoice claim form (OKUD 0504204). This means that public sector entities should only apply Form 0504204.

If the organization provides for restrictions on the supply of goods and materials, then for this a form of limit-fence cards M-8 is provided, which can be downloaded at the bottom of the article.

The M-11 contains the following information:

- name of goods and materials;

- sender (structural unit or department, OKVED type of activity);

- recipient (structural unit or department, OKVED);

- account (subaccount) of accounting (sender, recipient);

- number of goods and materials;

- cost.

The transfer of goods and materials can be carried out in the following cases:

- return of leftovers to the warehouse (unused during the production of goods and materials);

- return to the warehouse of rejects (production waste);

- delivery of materials from the warehouse to the responsible person;

- moving between warehouses, etc.

When is M-11 compiled

Consider the movement of goods within an organization.

The goods and materials are delivered to the warehouse, and the storekeeper draws up a document reflecting the receipt: for example, the receipt order M-4 (form according to OKUD 0315003). The data is also reflected in the material accounting card, for example, in the form M-17 (OKUD 0315008) (forms M-4 and M-17 can be downloaded below).

If there is a need to ship the goods within the company, then an M-11 invoice is issued. The basis for issuing a bill of lading is the request for material assets in the warehouse.

The waybill should be printed in three copies:

- one is kept by the sender;

- the second is transferred to the accounting department;

- the third copy is in stock.

Details and order of filling

Consider the order of filling M-11. The invoice is drawn up by an employee of the unit where the inventory is stored, and indicates:

- date of compilation;

- structural units sender and recipient;

- data on goods and materials (name, item number, unit of measure, quantity);

- in the case of a transaction coding system, the corresponding code.

Data on goods and materials can also be filled in by the person responsible for the release of products.

The document is internal, therefore, it is signed only by the employees responsible for the operation - financially responsible persons (hereinafter - MOL). The warehouse worker controls that the signature of the receiving or transmitting person, as well as the person through whom the transfer is made, is present. The MOL must indicate the full name and position.

After that, the accountant fills in the column "correspondent account" and indicates the cost indicators of goods and materials.

Requirement waybill, form 0504204, sample filling

Terms of storage

After processing the information from M-11, the accountant must ensure its archiving and storage. You can store an archive not only in an organization, but also in a public or private archive. Since the invoice claim is the primary accounting document, the storage period cannot be less than the period specified in Art. 29 of Law No. 402-FZ - at least 5 years after the reporting year.

Item 4, Art. 283 of the Tax Code of the Russian Federation provides for a longer storage period for documents confirming losses of previous periods.

Responsibility for drawing up and recording the invoice

Despite the fact that this document is internal, it accompanies the movement of values, and the persons who signed it are financially responsible. If something unforeseen happens to the property: theft, damage, other loss, then the responsibility of the MOL can be even criminal. Also, on the basis of M-11, warehouse and accounting are carried out. The storekeeper and accountant are responsible for the correct reflection of the credentials. Credentials are used to conduct inventories, and are also part of accounting and tax reporting.

Responsibility for the absence of a document is provided for in Art. 120 of the Tax Code of the Russian Federation.