World pharmaceutical market. Overview of the pharmaceutical market

The pharmaceutical industry is known to be one of the leading high-tech industries that largely determine the innovative and strategic security of the modern state. Many business theorists and practitioners are skeptical about the ability of domestic pharmaceutical companies to participate on an equal footing in the competition with the leaders of the global pharmaceutical industry. But, perhaps, it is worth looking at the issue more carefully and without prejudice and trying to find out, after all, whether Russian drug manufacturers have a chance. Is the situation as hopeless as the pessimists paint it? And if there is still a chance, how quickly can it be realized? And what needs to be done to enter the global pharmaceutical market of the modern world level? In what direction should Russian pharmacy move in order to reach world standards for the production and supply of medicines? For, no matter how difficult the situation may seem, not trying to do anything is always the worst possible scenario.

The article attempts to find answers to at least some of the questions posed. The study of the main trends, specifics and prospects of the global pharmaceutical market and Eurasian economic integration made it possible to formulate a number of features that critically affect the formation and growth of the export potential of Russian enterprises.

The first feature and at the same time a chance that should be taken into account when developing an export strategy for domestic pharmaceutical companies is the high volume and structural dynamics of the global pharmaceutical market, the development of which is characterized by a high increase in production volumes and a high level of profitability.

Based on the data presented in Figure 1, we can observe a general upward trend for the volumes of the global pharmaceutical market in the period under review. Interestingly, the market stability has been maintained for many years in a row: even the turbulent processes of the crisis year of 2008 reduced the production growth rate by only 1 percentage point. The inelasticity of demand for medicines is easy to explain, given the complex nature of the relationships that determine the pattern of morbidity in the population, and correctly relate it to different levels of drug exposure.

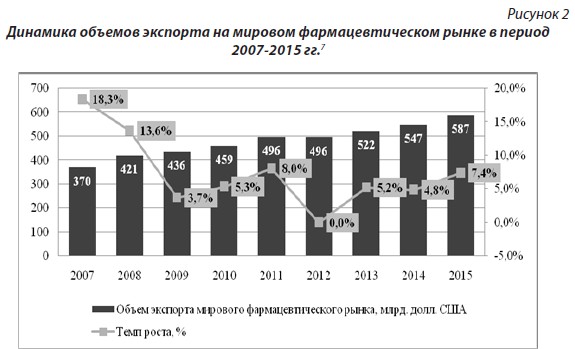

Slowdown in the growth rate of production volumes in the global pharmaceutical market in the period from 2009 to 2012 due to record levels of loss of exclusivity for large branded products, lack of new top sellers, sluggish uptake of innovative medicines, declining new product approval rates, cost sequestration policies by governments in most developed countries. The dynamics of export flows of the global pharmaceutical industry is shown in Figure 2.

The prevailing market share is occupied by developed countries. There are three main segments: countries of Western Europe; North America; pharmaceutical countries - Russia, China, Brazil, India.

The main factors of market dominance today are: - Significant investments in R&D of new medicines; - introduction of customized approaches to treatment based on the latest achievements in the field of genomics, biostatistics, informatics and medicinal chemistry; creation of flexible production cells-transformers capable of quickly re-profiling production and ensuring its scale; - transition to the unique production of personalized medicines, which makes it possible to practically eliminate competition from generic drugs; - complete transfer of production to GMP standards.

The leader in terms of exports of pharmaceutical products is Germany, whose production is developing according to a typical model of developed countries - great importance is attached to new research and development. The second place in the ranking of countries in the export of pharmaceutical products in 2015 is Switzerland. The United States, despite the large-scale transfer of production to other countries, continues to play an important role in the global pharmaceutical market. At the same time, it should be noted that the US pharmaceutical industry is not a leader in exports, since the state policy is aimed primarily at ensuring the needs and quality of its own healthcare.

Exports of pharmaceutical countries during the study period increased almost 3 times from 11.6 to 33.2 billion US dollars. The main factors that influenced the growth of the pharmaceutical industry in these countries were: an increase in the share of production of generic drugs; intensification of activities in the field of research and development of new substances; growth of export of composites - forms of medicines.

The second feature is a new segment picture of the global pharmaceutical market. When analyzing the commodity structure of exports, as a rule, three groups of drugs are analyzed: original or innovative drugs, branded generics and non-branded generics. Throughout the period under review, original medicines were in the lead in terms of sales - a share of more than 65%. However, we note a general negative trend for this group of drugs - a decrease over the period 2007-2015. by 11.7 p.p. On the contrary, the group of generics is characterized by a trend towards sales growth - by 6.7 p.p. for non-branded generics and by 4.9 p.p. for generic brands.

The share of original drugs in sales volumes is seriously decreasing, however, this drop is explained by the focus of companies from developed countries on the production of customized drugs for small genetically close groups of the population and is fully offset by rising prices. Also, the decrease in physical terms is also typical for the product segment of branded generics - they cannot withstand increased competition from non-branded analogues.

The combination of geographic and product segments allows us to conclude that in developed countries, as a percentage of consumption, original drugs are in the lead - 2011: 73%; 2015: 69%, but their share is slightly reduced due to an increase in the share of generics - 2011: 14%; 2015: 18%. Emerging markets are characterized by a reverse trend with the prevalence of generics, the share of which is increasing - 2011: 57%; 2015: 65% and a decrease in consumption of innovative drugs - 2011: 30%; 2015: 24%. Such trends can be explained by a gradual shift in the geographical balance of the global pharmaceutical market - and, ultimately, its research base - from developed to developing countries.

The third feature of the global pharmaceutical market is the growth in the efficiency of the processes of discovery, development and circulation of new types of drugs. An analysis of the data allows us to conclude that the funds invested in research and development of new types of drugs are stable - from 120 to 141 billion dollars for the period 2007-2015. It should be noted that fluctuations in the world economy during crises practically do not affect the dynamics of investment in R&D. The share of the United States in the study period for this indicator ranges from 36 to 40%, which allows us to speak of the country's indisputable leadership in innovative research. The cost of developing a new drug now averages US$2.5 billion, up from US$138 million in 1975. This eighteen-fold increase reflects the various technical, regulatory and economic challenges facing the field of scientific research. Increasing requirements for regulatory approval of a drug increase the cost of drug development. However, only 2 out of 10 drugs have revenue comparable to or greater than the investment in research and development.

Research and development costs are associated primarily with the creation of personalized medicines, which embodies an innovative scenario for the development of the pharmaceutical market. In the United States, research investment by pharmaceutical companies has grown consistently over the past 15 years, and more than double the spending by the National Institutes of Health in 2014. R&D spending by the pharmaceutical industry has also skyrocketed in Japan and the EU countries. Recently, however, the research sector has been heavily impacted by the fiscal austerity measures imposed by governments across much of Europe since 2010, leading to a gradual shift in R&D activity from Europe to the fast-growing markets of pharma nations.

The development of new types of drugs requires not only the improvement of scientific knowledge, but also the modernization of the entire process of production and sale of drugs. Applying technological innovations to healthcare delivery can help reduce costs and improve treatment efficiency. New developments include smart clothing and sensors to track vital signs, patient non-compliance and the clinical trial process; digital medicines such as smart tablets with microchips; and new drug delivery systems. The US government allocated $20 billion in 2014-2015. to finance a program to introduce electronic health records among patients and health care providers.

Similarly, big data processing and analytics can drive new ideas and help pharmaceutical companies improve the quality of their products and operate more efficiently. Companies can rely on data to understand existing medical needs, as well as identify target consumer segments that could benefit the most from therapy. Clinical and translational research opportunities can advance the development of personal genomic medicine, support the comparative analysis of the effectiveness of these therapies in real-world applications, and improve disease control programs.

The fourth feature of the global pharmaceutical industry is the externalization and alliances of pharmaceutical companies through horizontal / vertical integration, the creation of cross-border clusters, as well as regional integrated markets. An example of the implementation of an innovative scenario for the development of the pharmaceutical industry is the cooperation of transnational corporations with Indian companies in the development of new drugs. In particular, since 2013, Pfizer, in partnership with Aurobindo PHARMA, has been producing new generic drugs. Six leading pharmaceutical companies in India have formed the LAZOR alliance to share the best business practices and thus improve sales efficiency, reduce operating costs, and expand their presence in foreign markets.

Canada's pharmaceutical industry is made up of an ecosystem of multinational and local companies that, in a volatile domestic and international market, are forced to engage in mergers and acquisitions and integration in the form of alliances. In 2008, at the height of the patent bust and economic downturn, pharmaceutical multinationals accounted for more than 70% of M&A transactions. In the same year, 36 alliances involving pharmaceutical companies were registered in Canada. So, Genfarm, which was in the top 10 best generic corporations in Canada as part of Merck Generics, was acquired by the Milan corporation. In the same period, the Canadian company Apotex acquired the Belgian Topgen I.S.V. in order to increase access to the European generic market.

A flurry of mergers and acquisitions, joint ventures, strategic alliances, and partnerships is fueling the further expansion of Africa's markets. Recent examples include the purchase of Spimaco, a Saudi Arabian medical and pharmaceutical manufacturer, in 2011, a 50% stake in Ippharma from Morocco; the acquisition in 2013 of several African pharmaceutical companies by Jordanian pharmaceutical manufacturer Hikma; and joint ventures of the Indian pharmaceutical company Cipla in Morocco, Algeria and South Africa. A striking example of cross-border cooperation in the pharmaceutical and medical field is the European cross-border cluster Medicon Valley. Among the successful cross-border cluster projects, it is worth highlighting the joint project of Switzerland, Germany and France - the biotechnology cluster "BioValley" - BioValleyBasel.

As for Russia, the innovative scenario for the development of the pharmaceutical industry, which involves the gradual inclusion of Russian companies in the global pharmaceutical market, relies primarily on the creation of a modern, in all respects, single pharmaceutical market of the EAEU. Common approaches to regulating the circulation of medicines within the EAEU have been practically formulated. They are based on the requirements of the world's best pharmaceutical practices. However, the following strategic issues remain to be addressed:

First, there is a need to reorganize the supply chains that link the laboratory to the target market. The radical restructuring of the supply chain should be based on its fragmentation depending on the type of product and consumer segment; it should act as a means of marketing differentiation and a source of added value, a kind of two-way flow with counter information and product flows.

Secondly, the introduction of customized therapy in developed countries requires pharmaceutical companies to restructure the production and service system through the organization of flexible production cells-transformers. These cells would make it possible to quickly make adjustments to the production process, adapting it to the orders of specific consumers. For such a large-scale reorganization, pharmaceutical companies need to work in alliance with biotech companies, which, as a rule, develop and introduce new technologies first.

Thirdly, the transition to developments in the field of expensive gene therapy, as the most promising sector of modern medicine, leads to a narrowing of target consumer segments for pharmaceutical companies and, accordingly, to a decrease in income - albeit a temporary one. The active collaboration of healthcare providers and pharmaceutical companies, combined with the use of real data required for the R&D process, is expected to improve patient diagnosis and treatment, promote the deployment of smart prevention system and develop personalized health improvement plans. Personalized medicine will become more accessible as areas of science such as genomics, nanotechnology, robotics, and others reach maturity. To extract the full range of benefits from working in the personal medicine market, pharmaceutical companies must correctly build channels for the delivery of individualized treatments, organizing control over distribution. This becomes possible due to the implementation of the vertical integration model and the creation of specialized distributor enterprises along with the pharmacy network.

Fourthly, the penetration of the scientific community into the causes of diseases and the systematization of their symptomatic map contributes to a significant increase in the available information necessary for understanding, which is a colossal work that no one person or even no institution can handle alone. As a result, pharmaceutical companies work together with other companies, universities, and government to distribute, organize, and scientifically comprehend vast amounts of information, which eventually turn into knowledge that advances science at an unprecedented pace.

Fifthly, the creation of a regulatory framework for the EAEU common pharmaceutical market will provide unified approaches to regulating the circulation of medicines within the EAEU. Today, the rules are practically formulated, and they are based on the requirements of the best pharmaceutical practices in the world. However, it is necessary to actually reduce the barriers associated with the peculiarities of national markets: “launch” mechanisms for mutual recognition of registration of medicines, create the Pharmacopoeia of the Union, work out the possibility of joint inspection of manufacturers, and much more.

A unified system for regulating the circulation of medicines will contribute to the creation of a single pharmaceutical market and increase the availability of effective, safe, high-quality drugs for the population. In the case of effective joint action, significant transformations can be expected as early as 2020.

E.V. Sapir, - Doctor of Economics, Professor, Yaroslavl State University named after P.G. Demidova, Department of World Economy and Statistics - Head;

I.A. Karachev, Yaroslavl State University named after P.G. Demidova, Department of World Economy and Statistics - Postgraduate Student

№ 10/2 (106)19.10.2005

Global pharmaceutical market

The pharmaceutical market is one of the most highly profitable and fastest growing sectors of the global economy. Despite the general decline in the global economy in recent years, the pharmaceutical market continues to develop dynamically: its growth rate is approximately 6-10% per year. Unlike other industries, where net profit averages 5% of total income, in the pharmaceutical industry this index reaches 18% per year. According to experts, in 2004 the global pharmaceutical market grew by 7% and reached a record $550 billion in sales volume. Sales growth was noted in all major regions. At the same time, the maximum share of sales (45%) traditionally belongs to North America, where growth compared to 2003 was 8%. In the European Union, the pharmaceutical market grew by 6%, reaching approximately 26% of the world market ($ 144 billion). In Eastern Europe, sales grew by 12% to $9 billion. The Japanese market grew the slowest - by only 2%, while the most dynamically developing Chinese market, which grew by 28% and exceeded the same in terms of sales ($ 9.5 billion) indicator of the Eastern European market. The least developed today are the pharmaceutical markets of Africa, some Arab countries and a number of Latin American countries.

Several different factors contribute to the growth in drug sales. Firstly, this is a general increase in the incidence due to the increasing influence of technogenic factors and the deterioration of the environmental situation. Secondly, this is the trend of "population aging" in developed countries. Thirdly, in China, India, Russia, Eastern European countries, the growth in the income level of the population leads to the use of more expensive and high-quality drugs.

The pharmaceutical market is also growing due to the rapid development of such relatively new areas as the segment of biologically active additives (BAA) and the segment of generics - cheap analogues of well-known drugs. Today, the share of generics in the US, UK, Canada and Germany markets already reaches 30% and, according to experts, will continue to grow.

The key problem of the pharmaceutical market is the growth of research costs. Today, the average cost of developing one new drug is $ 800 million, and according to experts, this amount will exceed $ 1 billion in the near future.

However, the global pharmaceutical market will continue to grow in the coming years. While North America has been the fastest growing market in recent years, now, according to existing forecasts, a significant increase in sales will be observed in China, the Middle East, Latin America, Central and Eastern Europe.

The global “division of labor” in the field of drug production is reflected in statistics: out of the 50 largest pharmaceutical companies occupying more than 80% of the market, 20 companies are located in the United States (39.2% of the global pharmaceutical market), 18 companies in Europe (33.3% of the market ), 11 companies in Japan (7.8% of the market) and 1 in Israel

Trends in the Russian pharmaceutical market

In 2004, the volume of the entire pharmaceutical market of the Russian Federation in retail prices (FPP and parapharmaceuticals, as well as their sale in medical institutions (HCIs) amounted to $ 6.3 - 6.5 billion (including VAT, in retail prices) or $ 5, 1 billion in wholesale prices, which, according to various estimates, is 13-15.5% more than in 2003.

Russian pharmaceutical market volume in 2004

The growth of the Russian market in 2004 was due to several factors:

depreciation of the dollar;

Growth in consumer income;

Increased demand for medicines in the fourth quarter of 2004 in anticipation of the impending reform of the system of free and preferential leave;

Intensive development of the retail sector of the market, active development of pharmacy chains and their deep penetration into the regions.

Growth prospects for the Russian pharmaceutical market look more than convincing. If in the world the volume of the pharmaceutical market is 2 times higher than the volume of the perfumery and cosmetics market, then in Russia today these markets are comparable in volume. A similar situation is observed when comparing with the coffee and ice cream markets: in the world, the volumes of each of these markets correlate with the volume of the pharmaceutical market as 1:8 (each), and in Russia - as 1:4.

Drug consumption per capita has grown rapidly, reaching in 2004 $31-39 in final consumption prices, which means a 28% increase by 2003. According to the WHO, per capita drug consumption in the European Union is $220, in the US - $300, in Japan - $400, in Hungary - $50.

The pharmaceutical market grew in prices, but at the same time decreased in packages (in pieces) by 8%. This is in line with the trends of recent years: with the growth of prosperity, people began to buy more expensive imported drugs in about larger packages. In the structure of pharmacy sales, there was a clear trend towards a decrease in the share of inexpensive drugs.

An important characteristic of the domestic pharmaceutical market is the high controlling role of the state, carried out through strict licensing and certification, legislative restrictions on drug advertising, drug sales organization, etc. The share of public procurement of pharmaceuticals is also more significant.

The current 2005, according to experts, can significantly affect the alignment of forces in the market and its growth rates. The key factors influencing the development of the market are the transition from January 1, 2005 of pharmaceutical industry enterprises to work according to international GMP standards and the development of the Additional Drug Provision (DLO) program.

Taking into account the goals of the Federal program Benefit-2005, for which 50.8 billion rubles were allocated, the market growth in 2005 may reach 40% compared to 2004.

In 2004, the volume of imports of drugs into Russia amounted to $2.9 billion in customs value prices, which is 43.8% higher than in 2003. Such an increase may be due to a change in the structure of drug consumption towards expensive imported drugs.

Production of pharmaceuticals

If the United States accounts for 40% of the total world production of drugs, Russia - 0.3%. The output of domestic pharmaceutical products in 2004 grew by 17%, continuing the growth trend that has emerged in recent years.

The turning point for the domestic industry was 2003, when the volume of production crossed the billion dollar mark. For 2000–2004 production volume increased by 39%. However, the share of domestic products on the pharmaceutical market decreased from 42% in 2000 to 27% in 2004, losing 15% of the market. This is mainly due to the growth of imports: over the same period, it increased by almost 2.5 times. This is due to the fact that the basis of Russian pharmaceutical production is generic drugs 20-30 years old and drugs such as activated carbon, herbal tinctures and calcex. These drugs are produced in large quantities, however, according to the forecasts of the Ministry of Economic Development, this group of drugs has no future. Domestic production of substances was supplanted by Chinese production. Russian enterprises suffer from technological backwardness and lack of investment in the development of original drugs.

So, if state investments in the pharmaceutical industry in Russia in 2004 amounted to 53 million rubles. ($ 1.9 million), then in the United States in 2001 more than $ 48 billion was spent on the development of new drugs, while the costs of pharmaceutical companies amounted to $ 30.5 billion, and $ 17.8 billion came from the federal budget .

Investments of domestic companies in development are extremely small. The St. Petersburg company "Pharmacor" has invested about $100,000 in clinical trials and launching the production of new drugs, and most Russian manufacturers do not have the opportunity to invest even that much money in the development of new drugs.

By 2005, the transition of domestic enterprises to GMP standards (international standards for ensuring a modern level of organization of production, quality control of medicines and working conditions that meet the requirements of the European Union and the WTO) will require considerable costs for domestic manufacturers. Experts calculated that each of the manufacturers would need about $18 million to introduce such standards, and this could lead to the closure of a number of enterprises. However, the threat of termination of activities of Russian manufacturers due to non-compliance with GMP standards will become real only by 2006-2007, when their licenses begin to expire.

The DLO program can significantly increase the inflow of investments into the domestic pharmaceutical industry. In 2005, almost $2 billion was allocated for the purchase of drugs in the state program of preferential provision of citizens, which is equal to 30% of the entire market, and about 70% of drugs from the preferential list will be purchased from domestic manufacturers. This is associated with a sharp increase in demand for the production capacity of domestic pharmaceutical enterprises. Moreover, today buyers are often not even interested in what condition the plant is in - as long as it has a license for the production of medicines.

Distribution of pharmaceuticals

The distribution segment in 2004 showed the smallest (14%) growth compared to the manufacturing and retail sectors.

Of the significant changes in the Russian pharmaceutical market over the past five years, one can note a sharp reduction in the number of distributors. The situation when the 3 leading wholesalers account for more than 50% of the market is typical for most pharmaceutical markets in developed countries (in the USA this figure is 94%). It can be assumed that the process of concentration in the distribution sector will continue in the future.

Among the most pronounced trends in 2004 is the continued diversification of the business of the largest companies in the distribution sector, for example, the development of the production of drugs by Protek and SIA International, as well as the organization of some distributors of their own retail.

Retail segment of the pharmaceutical market

The volume of the FPP market in Russian pharmacies in 2004 amounted to $3.6 billion (including VAT) in wholesale prices, and $4.6 billion in retail prices.

Active development of pharmacy chains continues in the retail market. During 2004, 1,200 new network pharmacies were opened. The share of retail controlled by pharmacy chains, according to experts, averages 25-30%, but for million-plus cities this figure is much higher.

With such a significant growth of pharmacy chains, according to Pharmexpert, there are no national pharmacy chains in the Russian Federation (annual turnover over 2 billion rubles, presence in at least 6 federal districts), although some companies are already close to become them. The largest interregional chains (turnover of at least 1 billion rubles, presence in at least 2 federal districts): Apteki 36.6, Rigla, O 3, Natur Product, Imploziya (Samara ), Doctor Stoletov, BIOTEK, SoyuzPharma.

An important feature of pharmacy chains is the increase in the share of parapharmaceutical products in the assortment. The high growth rates of the assortment in this segment lead to the fact that the non-drug share in the turnover of the average classical pharmacy is already 15-20% today, and in the network it reaches 40% of the turnover.

The DLO program may also lead to a redistribution of the retail market. Participation in the Program is "long money", and very few domestic companies will be able to afford to finance the project. Therefore, the unaffordable conditions for participation in the Program for medium and small companies will lead to an accelerated strengthening of strong and weakening weak market players. Another turning point for the market may occur at the end of 2005, when beneficiaries will be able to exercise their right to leave the DLO system and prefer money to subsidized medicines. It is obvious that the most healthy categories of citizens will prefer real money.

Key players in the Russian pharmaceutical market

Manufacturers

Today, about 820 manufacturers operate on the Russian drug market, 340 of which are domestic companies, but the most active enterprises will be no more than 100.

According to F. Breitenstein, Executive Director for Central and Eastern Europe of the German company Pfizer, the largest drug manufacturer in the world, in 2-3 years the company plans to take a leading position in the Russian pharmaceutical market. "To strengthen our position in Russia, it is enough to change the marketing strategy, increase the budget for promoting our drugs and build a distribution network," F. Breitenstein believes. At the same time, according to him, the company is not going to open its own factory in Russia in the near future.

The leading 25 enterprises of the Russian pharmaceutical industry with the largest production volumes provided a total of 85% of the production of medicines. The share of financial and industrial groups "Microgen", "Pharmstandard", "Pharm Center", "Domestic drugs", "Veropharm" accounted for 43.8% of production. It should be noted that from 20% to 50% of products produced by domestic enterprises do not go to retail, but are sold through hospital and tender purchases.

Until 2003, the leader of the Russian pharmaceutical industry was the holding "Domestic Medicines", but the mergers and acquisitions that occurred in the market pushed it to 4th place - after NPO Microgen, CJSC Pharm Center and the Pharmstandard group.

Distribution

Of the huge number of pharmaceutical distributors registered in Russia (up to 4000 companies), according to various estimates, about 700-1200 companies are actively working. Consolidation is one of the opportunities for small distributors to stay afloat. An example of a successful merger of distributors is the ROSTA group, which in recent months has been steadily moving from 4th to 3rd place in terms of sales.

According to the results of 2004, the share of 6 national distributors among importers of FPP was 31.8%.

|

Distributors |

Import volume,$ |

Market share, % |

|

|

CV Protek |

400 461 088 |

||

|

SIA International |

284 440 628 |

||

|

Shreya Corporation |

102 748 914 |

||

|

ROSTA |

55 270 885 |

||

|

Apteka-Holding |

54 224 526 |

||

|

Quatrain |

31 211 469 |

||

|

Total |

928 357 510 |

The increased role of the retail link is changing the rules of the game: now large pharmacy chains largely dictate their requirements to distributors. This is naturally associated with a gradual drop in the level of profitability of the distribution link (according to various estimates, now it is 3-5% with rapidly growing costs).

Retail chains

According to Pharmexpert experts, the share of the retail market controlled by pharmacy chains is about 25-30%, the remaining 70-75% is accounted for by independent pharmacies.

The attractiveness of the retail pharmaceutical market is explained by its growth rates, high profitability and low structure. For example, if in the UK the top 5 pharmacy chains control 70% of the market, in the Russian Federation the top five own only 6% of the market.

The dynamics of turnover in network retail significantly exceeds the average dynamics in the market. The increase in turnover per 1 network pharmacy averages 25-35%, for a single pharmacy these figures are lower - 15-20%.

Pharmacies 36.6 have the largest number of pharmacies - 253 (as of March 2005) and Doctor Stoletov - 270. Recently, networks have been growing by an average of 50 pharmacies per year, mainly due to the purchase of ready-made pharmacy chains in the regions .

Natur Product has the largest regional coverage - 6 federal districts and 15 regions, Rigla and O 3 - 9 regions each in 5 federal districts.

The largest regional pharmacy chains are: "Pharmacor", "First Aid" (St. Petersburg), "Vita" (Samara), "Stary Lekar" (Moscow). The largest state pharmacy chains have been preserved in Tyumen - "Pharmacy" and Kurgan - "Kurganpharmacy".

According to Pharmexpert's forecasts, in the next three years, network players will continue to grow through mergers and acquisitions. By 2008, 4-5 pharmacy chains will control 50-60% of the national retail market.

Comparative efficiency of enterprises in the industry.

Comparison of the performance of the leading enterprises in the industry based on the indicator TP-Index conducted for the following companies : .

| Company | Field of activity | date of creation | Year of measurement | Turnover, USD | Company staff | TP - index | A source | The country |

| Pfizer | Pharmaceutical industry | 1849 | 2004 | 52516000000 | 115000 | 456660 | Hoover's | USA |

| Novartis | Pharmaceutical industry | 1996 | 2004 | 28200000000 | 81000 | 348148 | Site K | Seamstress king |

| Pharm standard | Pharmaceutical industry | 2004 | 2004 | 95500000 | 5250 | 18190 | www.pharmvestnik.ru | Russia |

| Farm Center | Pharmaceutical industry | 2003 | 2004 | 64100000 | 9900 | 6474 | CMI Pharmexpert | Russia |

| Microgen | Pharmaceutical industry | 2003 | 2004 | 55900000 | 7815 | 7152 | Site K | Russia |

| McKesson HBOC Inc. | Pharmaceutical distributor | 1833 | 2003 | 80514600000 | 25200 | 3195024 | Hoover's | USA |

| Tamro Oyj | Pharmaceutical distributor | 1895 | 2004 | 6624600000 | 3909 | 1694705 | Hoover's | Fin- landia |

| Protek | Pharmaceutical distributor | 1990 | 2004 | 1200000000 | 5300 | 226415 | Site K | Russia |

| SIA International | Pharmaceutical distributor | 1993 | 2004 | 1055000000 | 6400 | 164843 | Site K | Russia |

| CVS | Retail network | 1963 | 2003 | 26588000000 | 83000 | 320337 | Fortune N175 | USA |

| Boots Group PLC | Retail network | 1849 | 2004 | 9722400000 | 68910 | 141088 | Hoover's | Great- Britannia |

| Pharmacies 36.6 | Retail network | 1999 | 2004 | 210000000 | 6000 | 35000 | Site K | Russia |

| Pharma-core | Retail network | 1991 | 2004 | 84000000 | 1700 | 49411 | Site K | Russia |

| O3 | Retail network | 2003 | 2004 | 80000000 | 1300 | 61538 | Site K | Russia |

The presented data clearly demonstrate the fruits of extreme concentration and high competitiveness of the Western market. The indicators of the TP-index of Western pharmaceutical manufacturers are 20-40 times higher than the indicators of domestic leaders in production; for distribution, this indicator differs by 7-20 times; for retail by 2-10 times. Differences in the turnover of companies are also within ordinal values. From this picture it follows that the chances of domestic players in the pharmaceutical market to survive in a competitive clash with Western players are small. The only thing that saves the situation today is the paradoxical circumstance that the Russian market of pharmaceutical products is still not attractive enough for Western players in terms of its size. However, there are already numerous signs of growing interest in the Russian pharmaceutical market.

TP-index (Turnover-to-Personnel index) - shows the ratio of the company's turnover for the period (in this case, for the year) to the average number of employees working in the company. TP-index is one of the simplest and most reliable ways to compare the commercial performance of enterprises

The pharmaceutical market is generally considered to be one of the most profitable in the world, and Russia is no exception.

The Russian pharmaceutical market is in the TOP-10 largest pharmaceutical companies. world markets.

One of its differences is the focus on imports (according to various sources, from 65% to 76% of drugs consumed by the population of our country are produced abroad). The leaders of imported medicines in our country are SANOFI-AVENTIS (France) and NOVARTIS (Switzerland). And only in the honorable third place is the company PHARMSTANDART - a single domestic manufacturer, which is listed in the TOP-20 leading players in this business in Russia.

It is due to such a feature as an orientation towards imports, as well as geographical characteristics in Russia that much attention is paid to the wholesale link.

Pharmaceutical distributors ensure the availability of foreign medicines on our market and also distribute the products of domestic manufacturers. The leaders in this direction, as well as in production, remain quite stable and the 15 largest hold up to 78% of the market, which is a very high indicator of concentration. Distributors are trying to create their networks with representative offices in many cities to ensure a stable flow of the required amount of products. A large part of sales, both in the commercial and in the hospital segment, depends on their work. Indeed, it is thanks to the well-established supply chain, as well as the availability of goods in the distributor's warehouse, that it will depend on how many prescribed prescriptions will be provided with a purchase. According to previous years, the leaders in the distribution segment will be such companies as SIA International and CV Protek. In the volume of the pharmaceutical market, their total indicator reaches 33%. Smaller wholesalers are also starting to create an extensive network of warehouses (for example, FK PULSE, IMPERIA-PHARMA). Also high rates of development are shown by such distributors as R-PHARM and BIOTEK. According to experts, there are approximately 2,500 pharmaceutical wholesalers in Russia, of which 2,300 are small.

Pharmacy retail chains are one of the steps in the pharmaceutical distribution chain. In contrast to wholesale trade, there is a low concentration of the market, the 10 largest companies account for only 15% of the market.

As for the financial indicators on the domestic pharmaceutical market, the following can be indicated:

- Almost all the largest domestic producers increased their revenue in 2012, however, the indicators are different for everyone and the increase ranged from 2 to 48%.

- Also, the increase in prices for the year amounted to around 6-7%.

- Large pharmacy chains are balancing at the break-even point and the average profitability is only 1%.

These indicators are presented for 2012, it is too early to speak for 2013, but according to the general dynamics, we can talk about the overall growth of financial indicators. The main factors giving such dynamics are inflation and an increase in the share of expensive products in the sales structure. As well as active influence on the part of the State, but more on that later.

Why farm. market in Russia is one of the most profitable? Let's outline the main reasons:

- The population of the country, 143 million people, and all of them are potential consumers of medicines.

- Most of the population is in adulthood or old age, and since the extension of life and the treatment of accumulated diseases are one of the main priorities of people, a significant part of the income is spent on providing for this need.

- The researchers concluded that Russians tend to take medication for any reason, use self-prescription. This is due to the mentality of people, as well as an imperfect healthcare system. The consumption of medicines in our country, per 1 person, is much higher than in developed countries.

- The presence on the market of low-quality medicines, or no effect. People use them in large quantities without getting results, and very often they start the disease. Subsequently, the medication intake is again increased.

At present, state regulation has a very great influence on the domestic pharmaceutical market, strategies are being developed and put into practice to replace imported medicines with Russian ones. For example, when working with vital and essential medicines, it is Russian manufacturers that remain in a winning position, because The surcharge is formed depending on the manufacturer's price. The introduction of new drugs to the market is also one of the most important areas of the market. Many importers are increasingly thinking about opening contact manufacturing facilities in our country. The state seeks to actively support and motivate foreign pharmaceutical companies for such cooperation, because this makes it possible not only to create new jobs, but also to ensure the flow of funds to the country's budget.

The state is actively taking measures to regulate the pharmaceutical market, in particular, it forms a local manufacturer. Attempts in this direction have been made since 2010. In general, they started talking about the strategy 5 years ago, when the Pharma-2020 strategy was still under development, it became one of the 3 main documents that determine the development of the industry for decades to come. In second place is the federal target program "Development of the pharmaceutical and medical industry of the Russian Federation for the period up to 2020 and beyond" and in third place - "Strategy for drug supply of the population of the Russian Federation until 2025".

The Pharma-2020 strategy stipulates that it is planned to increase the share of domestic drugs in the domestic market to 50% by 2020. It is also planned to make changes in the nomenclature of medicines, towards an increase of up to 60% in the portfolios of innovative drugs. A lot of money is invested in scientific research. And all this against the background of a general increase in the number of industries, with all the ensuing consequences.

Recall that in 2013, the Federal Law of 05.04.13 No. 44-FZ “On the contract system in the field of procurement of goods, works, services to meet state and municipal needs” was adopted, it will come into force on 01.01.2014, despite the fact that that more than 30 acts relating to this law are still under development. Therefore, many lawyers, as well as everyone who is interested in public procurement, are anxiously waiting for the new year and what it will bring with it. Also, according to experts, the introduction of requirements for mandatory compliance with production standards from 01.01.2014 (Federal Law "On the Circulation of Medicines" No. 61-FZ) can have a significant impact. Those enterprises that cannot be modernized will have to close. Which will also affect the rise in prices for domestic medicines.

So, the Russian pharmaceutical market is now at the stage of restructuring and active modernization. The state is making a lot of efforts to bring domestic producers to the forefront. But how successful their measures will be, we will probably judge closer to 2020, when all the planned strategies will come true.

According to the materials of the Ministry of Industry and Trade of Russia

Research DSM Group

Natalya Ziskina,

Recruitment company AVICONN

Recruitment Consultant

This market analysis is based on information from independent industry and news sources, as well as official data from the Federal State Statistics Service. The interpretation of the indicators is also based on the data available in open sources. The analytics includes representative areas and indicators that provide the most complete overview of the market in question. The analysis is carried out for the Russian Federation as a whole, as well as for federal districts; The Crimean Federal District is not included in some surveys due to lack of statistical data.

GENERAL INFORMATION

The pharmaceutical industry is an industry concerned with the research, development, mass production, market research, and distribution of medicines primarily for the prevention, alleviation, and treatment of disease. Pharmaceutical companies may work with generics or originator (branded) drugs. They are subject to a variety of laws and regulations regarding drug patenting, clinical and preclinical testing, and marketing practices for off-the-shelf products.

Generic - a drug sold under an international generic name or under a proprietary name that differs from the brand name of the drug developer. After the entry into force of the TRIPS Agreement, generics are usually referred to as drugs whose active substance has expired patent protection or patented drugs that are produced under a compulsory license. As a rule, generic drugs do not differ in their effectiveness from the "original" drugs, but they are much cheaper. Support for the production of generics, their use in medical practice and their replacement of "original" branded drugs is one of the strategic goals of the World Health Organization in ensuring access to medical care.

Parapharmaceuticals (biologically active additives, dietary supplements) are compositions of biologically active substances intended for direct intake with food or introduction into food products.

The production of pharmaceuticals is one of the most cost-effective and highly profitable sectors of the economy both in Russia and abroad.

OKVED CLASSIFIER

According to the OKVED classifier, the production of pharmaceuticals belongs to section 24.4 "Manufacture of pharmaceutical products", which has the following subsections:

24.41 "Production of basic pharmaceutical products";

24.42 "Manufacture of pharmaceutical preparations and materials";

24.42.1 "Production of medicines";

24.42.2 "Manufacture of other pharmaceutical and medical products".

INDUSTRY SITUATION ANALYSIS

Since the end of 2014, the Russian pharmaceutical market has been affected by such negative factors as a decrease in the solvency of the population due to the difficult economic situation in the country, as well as anti-Russian sanctions. At the same time, however, market participants highly appreciate its potential, which is confirmed by the development of existing and construction of new production enterprises, the creation of alliances of domestic and foreign enterprises.

Profitable franchises

Investments from 1,500,000 rubles.

At the same time, the Russian pharmaceutical market is one of the fastest growing in the world, showing high growth rates in 2008-2015 - the average figure was 12 p.p. However, despite the growth of the market in rubles, in dollar terms it is declining due to the devaluation of the national currency. Due to the fact that the bulk of manufacturers fix their sales in dollars, the market volume in 2015 was comparable to the volume of 2007-2008. Such a drop has led to the fact that the Russian pharmaceutical market is not included in the TOP-10 of the world's leading pharmaceutical markets.

Figure 1. Market size of pharmaceutical products in end use prices in 2008-2015 (according to DSM Group)

There is also a decrease in market capacity in physical terms: in 2014 it amounted to 2.7%, in 2015 - 4.2%. The decline in sales of the commercial sector (pharmacies) has been going on for the past two years. Some growth shows only the hospital sector.

In total, more than 1,100 players were present on the Russian market in 2015. At the same time, the TOP-20 manufacturers account for 55.1% of the value of sales.

Figure 2. Dynamics of the pharmaceutical market in 2013-2015, mln. packs (according to DSM Group)

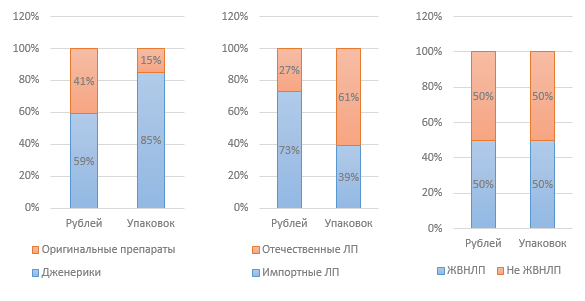

Figure 3. Market structure by various indicators in 2015 (according to DSM Group)

Profitable franchises

The weighted average price for VED drugs, according to DSM Group analytics, in 2015 amounted to 124.5 rubles. At the same time, the price for a package of a domestic drug is 68 rubles, and an imported one is almost three times higher, 180 rubles. For 12 months of 2015, the cost of Vital and Essential Drugs increased by 2.8%. Drugs not included in the list of Vital and Essential Drugs increased in price by 14.2%.

State regulation has a significant impact on the industry. In particular, as part of anti-crisis measures, Decree of the Government of the Russian Federation No. 98-r dated January 27, 2015 “On approval of the plan of priority measures to ensure sustainable economic development and social stability in 2015” was issued, part of which concerned the pharmaceutical industry.

The first initiative was related to the regulation of prices for drugs from the list of vital and essential drugs (VED); price indexation was assumed at the level of 30% for vital and essential drugs belonging to the category of the lower-middle price segment (up to 50 rubles). However, this initiative remained unfulfilled. Taking into account the fact that prices for vital and essential drugs are regulated by the state, this means a decrease in the profitability of manufacturers of these drugs, which, as a result, may lead to curtailment of the production of these drugs. Only state support for manufacturers can help to avoid this.

In 2016, it is planned to develop a program to support VED manufacturers in the segment up to 50 rubles. in the form of subsidizing part of the costs associated with their production. The deadline for the development of the plan is June 2016. With a high probability, this may mean that this program will not be implemented in 2016.

Profitable franchises

The Vital and Essential Drug List approved in 2012 was revised in 2015; at the beginning of 2016, the list was officially approved by the Cabinet of Ministers of the Russian Federation. 43 drugs were added to the list, 6 of which are from Russian manufacturers; one medicinal product with a Russian manufacturer was excluded. Thus, today the list includes 646 items.

Order No. 98-r limited the participation of foreign companies in public procurement. A Decree was adopted on the restriction of imported drugs, the essence of which is that foreign-made drugs are not allowed for state procurement in the event that two or more manufacturers from Russia or the EAEU participate in the competition.

Profitable franchises

The Decree also provides for the allocation of an additional 16 billion rubles for drug provision of beneficiaries (LLO program) in connection with a change in the exchange rate. In 2015, drugs worth 101 billion rubles were dispensed under this program, which is 20% higher than in 2013-2014.

Since 2012, discussions have been underway on a bill that would allow OTC drugs to be sold outside of pharmacies, such as in grocery stores. However, the issue requires serious discussion; no results yet. Also at the end of 2015, the Ministry of Health submitted for public discussion the draft Federal Law “On Amendments to Certain Legislative Acts of the Russian Federation in Retail Sale of Medicinal Products Remotely”, which provides for the possibility of selling medicines via the Internet. If the law is passed, it will come into force on January 1, 2017.

Another innovation that is being actively discussed at the present time is the electronic labeling of drug packages using a chip that will contain all the parameters of the drug, due to which, as expected, it will be possible to avoid counterfeit and low-quality drugs in pharmacies and hospitals.

Since January 2015, the Federal Law of December 31, 2014 No. 532-FZ “On Amendments to Certain Legislative Acts of the Russian Federation in Part of Counteracting the Turnover of Counterfeit, Counterfeit, Substandard and Unregistered Medicines, Medical Devices and Falsified Dietary Supplements” came into force, which toughened administrative and criminal liability for the circulation of counterfeit dietary supplements. In order to regulate the market of dietary supplements manufacturers, in particular to control compliance with the law, in 2014 a self-regulatory organization (SRO) Non-profit partnership "Association of manufacturers of dietary supplements for food" was created.

Profitable franchises

As a result of inspections (test purchases) conducted in 2015, serious violations were revealed by some dietary supplement manufacturers. In particular, prohibited substances were present in the preparations. This led to a drop in sales of some categories of dietary supplements by 4% in value terms and by 16% in real terms. This precedent became the basis for the preparation of a draft law on the transfer of powers in the field of licensing and control over the circulation of dietary supplements from Rospotrebnadzor to Roszdravnadzor.

In the commercial segment, the share of sales of dietary supplements is 4.6%, which makes them the best-selling non-drug product. The growth rate of sales of dietary supplements in recent years has been 12-14% annually, with the exception of 2015, when due to the crisis in the economy, sales growth was 6%. Experts attribute the slowdown in sales growth to the negative information background around low-quality and ineffective dietary supplements. Currently, there are about 2,200 different brands of dietary supplements and about 900 manufacturers on the market.

Since January 1, 2016, a single market for the circulation of medicines and medical devices has been launched within the framework of the Eurasian Economic Union. Potentially, this could lead to a significant increase in competition for Russian producers. On the other hand, the creation of a single pharmaceutical market can facilitate the import of pharmaceutical products, which currently has a number of difficulties.

Figure 4. The volume of drug imports to Russia in 2014-2015, million dollars (according to DSM Group)

According to the results of 2015, the volume of imports of medicines decreased in value terms compared to 2014 by 33%. The decrease in the volume of imports of medicines does not correlate with the dynamics of the volume of imports of substances, since most domestic manufacturers use imported substances; the decrease in the volume of their imports in 2015 amounted to 5%.

Until January 1, 2016, every domestic pharmaceutical manufacturer had to obtain a GMP compliance certificate, a new industry standard. It is planned to complete the transition to this standard by 2017. Since 2016, both Russian and foreign manufacturers must comply with the standard. Despite the fact that the Russian standard is equivalent to the GMP adopted in the European Union, it is the Russian certificate that is required. The procedure for obtaining a certificate for Russian and foreign manufacturers is different - for the latter it is much more complicated and more costly.

According to a study conducted by the Deloitte consulting company, among the main problems in the industry in 2015, market participants name: the current state of the Russian economy (26% of respondents) and the imperfection of legislative regulation of the industry (24% of respondents). Taking into account these problems, as well as taking into account other factors of influence, we can say that the pharmaceutical industry in Russia today has the following weaknesses:

High dependence of the market on imports of medicines and substances;

Orientation of the market to the domestic consumer, untapped export;

Lack of flexibility in price regulation of the industry;

Insufficient level of state support for local producers.

The main trends in business development include the plans of market participants to bring new medicines to the market, as well as the localization of production in Russia - in the form of a joint venture or their own production complex.

ANALYSIS OF THE DATA OF THE FEDERAL STATE STATISTICS SERVICE

Rosstat data, which the service receives by collecting official data from market participants, may not coincide with the data of analytical agencies, whose analytics are based on conducting surveys and collecting unofficial data.

Figure 5. Dynamics of financial indicators of the industry under section OKVED 24.4 in 2012-2015, thousand rubles

Figure 6. Dynamics of financial ratios of the industry under section OKVED 24.4 in 2012-2015, thousand rubles.

As can be seen from the graphs, the situation in the industry is stable, there is a permanent growth of all financial indicators: revenues, profits; at the same time, the amount of capital in the companies of the industry is growing. We can also note the growth of gross margin. A decrease in the share of long-term liabilities is characteristic; working capital deficit is covered by short-term loans. The volume of shipments is also growing, which indicates the development of local production and an increase in market capacity.

Figure 7. Dynamics of shipment volumes by industry in 2012-2015, thousand rubles