Office of the PFR in the Krasnozersky district of the Novosibirsk region. The employee is retiring: what documents does the employer submit to the Pension Fund Spv 1 sample filling

Registration of a pension is carried out by each citizen independently after the grounds established by law come. To assign pensions, data on individual insurance experience are used. Reporting on them, as well as information on contributions, is submitted by the employer in the order of quarterly or annual reports.

In the event that the moment of the emergence of the right to pension payments falls within the period between two reports, an individual has the right to apply to the enterprise in which he is employed for the provision of the SPV-2 form for a pension to the Pension Fund. The basis for submitting this form in the inter-reporting period is an application from an employee.

Dear readers! The article talks about typical ways to solve legal issues, but each case is individual. If you want to know how solve exactly your problem- contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FOR FREE!

The report will contain information about the specific length of service of the employee at the current moment. If the information has not been submitted earlier, the entitlement to a pension will not be taken into account.

In January 2019, the Resolution of the Board of the Pension Fund No. 2p was issued, according to which the previously valid SPV-2 form became invalid, starting from February 17, 2017.

In order for an employee who has received the right to a pension to receive timely accruals, the employer's accounting department prepares the SPV-2 form and submits it to the local FIU division.

General information about insurance experience

The concept of seniority is a legal fact, according to which the right of a citizen to receive pensions and various other payments, including benefits, changes or arises. It is necessary to distinguish between labor, general and insurance experience. Of particular interest is the insurance experience, because. it will influence the procedure for calculating and assigning a future pension.

Under the general insurance experience is understood the duration of the work of a citizen, during which insurance premiums were accrued and paid, as well as other periods provided for by law (for example, the inability of an employee to fulfill his work duties for certain valid reasons).

The insurance period to be included in the total insurance period may be:

- the fact of temporary disability with the appointment of social insurance benefits;

- maternity leave;

- leave to care for a dependent with 1 disability group;

- taking part in socially useful work with the appointment of benefits as an unemployed person;

- military service (by conscription);

- for military family members - living in places where employment is impossible.

In such cases, the limitation established by law applies - the period taken into account in the insurance period cannot exceed 5 years. Another condition for applying such a period to the offset is the presence of other periods with employment (before or after).

When a citizen carries out labor activity in conditions of hazardous production, harmful working conditions due to the climatic features of the region, in territories outside the country where there is a special status for paying insurance premiums, a special insurance period is accrued.

What it is?

Form SPV-2 for pensions in the latest edition must be provided by each employer who calculates insurance premiums and transfers them in accordance with the current provisions of the law. The form is intended for submitting individual information about the employee to the Pension Fund for the subsequent appointment of an insurance pension.

If until 2019 there was a different form for submitting information (SPV-1), then later a new version of the report was installed. The reason for the appearance of the updated version of the document lies in the absence of a division of contributions into insurance and funded parts due to the previously established moratorium affecting the accumulation of pensions for all individuals with Russian citizenship.

The new form allows you to reflect only information about the insurance period of an employee of the employer and establish the fact of the presence or absence of taxable payments. The SPV-2 form has been expanded with information on the additional rate for current insurance premiums for those citizens who are entitled to claim an early pension due to the length of service in special conditions.

The general form SPV-2 is suitable for submitting information for calculating pension payments of all types. The law allows submission of information in electronic form or on paper. The employer is obliged, within 10 days after receiving the application from the employee, to prepare a report of this type and send it in a convenient way to the Pension Fund.

Information is transferred to the local branch at the place of registration of the current insured-employer. The form must be accompanied by an ADV-6-1 inventory. After sending the report, the employee receives a copy of it.

Purpose of the SPV-2 form for pension

With the help of the SPV-2 report, the Pension Fund employees receive additional information regarding the insured person and the situation with his insurance premiums during the previous three months on the eve of retirement. With the help of this form, information about the insurance experience of the citizen of interest at the time of the interreporting period remains in the FIU.

On the eve of the adoption of the updated version of SPV-2 in 2019, there were some changes in the field of pension legislation, which was the reason for the creation of a new SPV-2.

This information is sufficient for the FIU to check and assign the appropriate pension payment to a specific person. If this information is not submitted by the time of retirement, the citizen can only count on a smaller pension.

In the future, the amount of the payment is subject to review and adjustment, but this will require additional time, during which the pension will be paid in a smaller amount.

Differences from earlier version

Filling out the SPV-1 form required the indication of data on contributions for the insurance and funded parts. The main difference of the form since 2019 was the absence of the need to divide all paid contributions into two parts (funded and insurance). At the same time, the employer must indicate whether employee contributions have been made at an increased rate.

The report includes information on the insurance period of the employee who is about to retire, and also confirms the accruals made on insurance premiums to the insurance part for the last three months.

Information in SPV-2 is indicated on an individual basis by the amount of the total tariff, with further distribution by the fund's employees into two types of pension contributions. For this reason, the form blank contains only a request for the very fact of the existence of deductions on insurance premiums.

The report to the FIU is accompanied by an additional inventory in the new form (ADV-6-1 instead of ADV-6-3).

When filling out a new form, reporting periods are coded differently:

Procedure for submission to the FIU

The basis for the preparation of the report is a statement from an employee, a future pensioner. On the eve of receiving payments for a labor pension, disability, length of service, and other reasons, a citizen applies in advance to the accounting department of the employing organization with a request to prepare a reporting document. Thus, in order to provide the required report to the FIU, only the initiative of the employee in the form of an application is sufficient.

It is allowed to issue an application with the following text of the request: “provide individual information about the length of service and the accrual of insurance premiums for compulsory pension insurance to the PFR department ...” Then indicate the reason “in connection with the registration of a pension ...” with the definition of the type of pension. In the application, the employee also reflects the period from which the pension is expected to be issued.

After receiving the application, the accounting department prepares a report and submits it to the local branch of the fund within 10 days with the issuance of a copy of the report to the employee. The law provides for the possibility of applying in advance, 1 month before the upcoming retirement.

The new SPV-2 form does not reflect information on exact transfers of contributions, they are reflected in the current quarterly reports.

The SPV-2 report is prepared separately from the main insurance reporting. For this reason, for an employee who applies for a report on the eve of the submission of the main reporting for the quarter, in any case, documentation will be prepared in connection with the onset of the right to pension payments, and sent along with ADV-6-1 separately from other reports. This provision was fixed in the Resolution of the Pension Fund of the Russian Federation No. 192p in 2006 and continues to be valid at the moment.

After filling out the report, the document must be signed by the head and certified by the seal of the organization. The prepared report is to be sent to the Pension Fund in a convenient way for the employer (on paper or electronically).

A copy of the sent document is handed over to the employee to confirm the fact.

With regard to individual entrepreneurs who independently pay contributions, the SPV-2 report is prepared by them. It is within the powers of the individual entrepreneur to transfer the prepared report to the employees of the fund in a similar manner. Together with the report, an application is submitted with a request to assign a labor pension.

Fund employees may refuse to accept documents from individual entrepreneurs, especially when submitting reports once a year. This is due to the rule that the last periods of activity are included in the insurance period only after the payment of the last contributions.

When to submit?

Due to the individual procedure for submitting the SPV-2 report, the law does not establish specific deadlines for submitting the document. The report must be submitted on the eve of the citizen's retirement. In order to timely submit the form, a citizen will need to write an application to the employer at least 10 days before the right to retire.

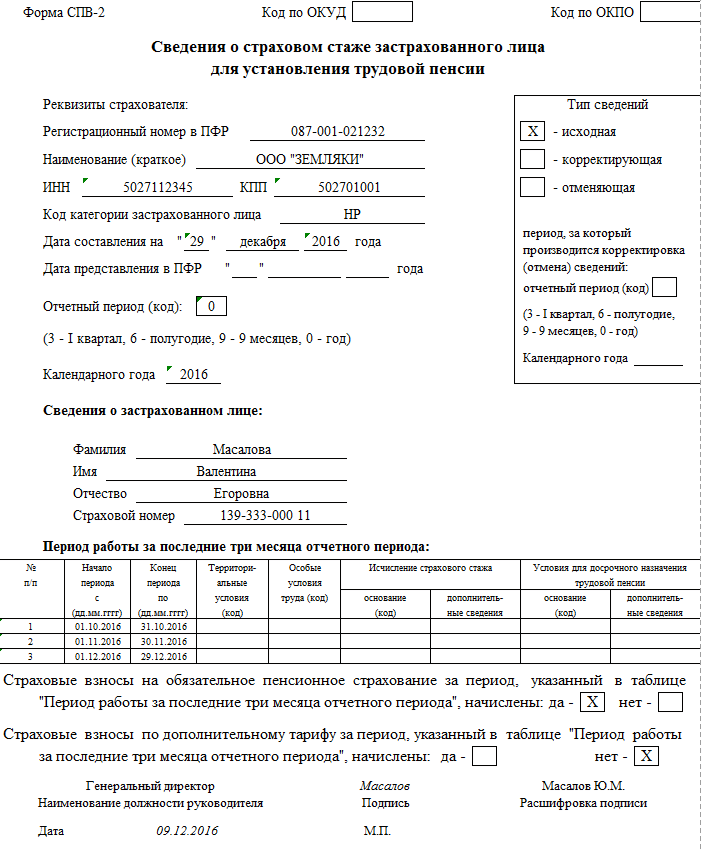

Filling rules and example

The form is a column for filling in information about the employer, employee and information about insurance premiums. The form for downloading presented on official Internet resources will allow you to quickly prepare a report taking into account the general established requirements for all types of reporting.

When preparing a report, it is necessary to take into account certain filling rules:

- In the information section about the employer, the registration number in the FIU, the name of the organization, the taxpayer number of the legal entity, and his are reflected.

- When specifying information about an employee, his category code is indicated according to the current classifier.

- In the column "date of compilation" it is necessary to indicate the expected date of the emergence of the right to pension payments. Fill in format "DD month YYYY", for example, "September 1, 2019".

- The column with the date of submission is filled in by the fund employee independently.

- From the personal information about the employee, information about the last name, first name, patronymic, is entered.

- Near the desired type of information, indicate "X", choosing from the original, corrective or canceling.

- In the section on information on contributions for the period, it is necessary to confirm their presence or absence (“Yes” or “No”).

The new form also indicates information about the deductions made at additional rates for insurance premiums with the obligatory reflection of the relevant codes for the specified rates.

Responsibility

The law does not establish penalties in the absence of timely submission of the SPV-2 form to the Pension Fund. There is also no administrative responsibility. The law considers this form as settlement documentation, which, unlike reporting, is not subject to control and liability in case of non-provision.

The absence of a timely submitted form to the FIU only entails unpleasant consequences for the insured citizen who is about to retire. In the event that the last three months play a significant role in the formation of a length of service sufficient for granting a pension, the absence of a report entails the refusal of the fund to grant a pension.

In addition, in the absence of SPV-2 by the time of retirement, a citizen will only be able to count on a smaller amount of pension payments due to the impossibility of taking into account the last periods of work.

Despite the fact that the procedure for creating an SPV-2 report is not particularly difficult, the lack of provisions in the legislation on the employer's liability for the fact of late submission or refusal to submit the form requires special control on the part of the future pensioner so that the necessary information is received by the fund employee in the right time in the right way.

But if an employee contacts the accounting department with a request to submit individual information to him, then you are required to submit them to the FIU. Previously, such information had to be submitted in the SPV-1 form. approved Resolution of the Board of the Pension Fund of the Russian Federation dated July 31, 2006 No. 192p. In August, the Ministry of Justice registered a new form with approved Resolution of the Board of the Pension Fund of the Russian Federation of July 21, 2014 No. 237p to provide such information.

Why is the SPV-2 form submitted?

Information on contributions and length of service for a particular employee is received by the FIU from the employer on a quarterly basis paragraph 2 of Art. 11 of the Law of 01.04.96 No. 27-FZ. However, as a rule, the date of appointment of a pension falls on the inter-reporting period. And the FIU does not have information about the employee's insurance experience during this time. Therefore, the PFR authority will not be able to take it into account when calculating the employee's pension.

To correct this, an employee who has submitted an application to the FIU for a pension may apply to you with an application in any form for the submission of individual information to the territorial body of the FIU during the interreporting period. p. 82 of the Instruction, approved. Resolution of the PFR Board of July 31, 2006 No. 192p (ed. with amendments that have not entered into force) (hereinafter - Instruction No. 192p). Moreover, the employee is not obliged to submit any requests from the FIU to you.

Why it became necessary to introduce a new SPV-2 form for submitting such information and from what point insurers are required to provide information on this form, we were told at the branch of the Pension Fund of the Russian Federation for Moscow and the Moscow Region.

FROM AUTHENTIC SOURCES

Deputy Manager of the Department of the Pension Fund of the Russian Federation for Moscow and the Moscow Region

“ The emergence of the SPV-2 form is associated with changes in legislation, in particular, with the introduction of insurance premiums at an additional rate for employees who are entitled to an early old-age pension due to special working conditions. The new form, unlike the SPV-1 form, does not provide for the reflection of the amount of insurance premiums accrued by the insured for the insurance and funded part of the labor pension for the insured person (for the current period starting from the 1st day of the next reporting period to the date of assignment of the pension). In the SPV-2 form, the insured reflects only information about the employee's length of service and indicates the fact that he has accrued insurance premiums on the insurance part of the employee's pension for the specified period.

Since 2014, the SPV-2 form has been submitted to the territorial body of the PFR by the employer at the request of the insured person, who has conditions for establishing a labor pension.

Therefore, if the information is submitted in accordance with the SPV-1 form (even before the publication of the SPV-2 form), we will not accept it.”

Note that you are required to submit the SPV-2 form to the FIU when an employee applies for a labor pension not only for old age, but also for any other type of labor pension: both disability pension and survivor's pension. In the latter case, family members of the former employee may contact you.

Form SPV-2 must be submitted to the FIU on paper or in electronic form within 10 days from the date the employee applied to the employer with an application m (hereinafter - Instruction No. 987n). However, nothing is said about which days these are - working or calendar, and which branch of the PFR to submit information to - at the place of registration of the employer or at the place of residence of the employee.

FROM AUTHENTIC SOURCES

“ The insured is obliged to submit the SPV-2 form within 10 calendar days from the date of receipt of the application from the employee applying for a pension to the PFR office at the place of his registration, and not at the place of residence of the employee p. 36 Instructions, approved. Order of the Ministry of Health and Social Development of December 14, 2009 No. 987n (hereinafter - Instruction No. 987n). Information from this form is entered into the database by the PFR department at the place of registration of the employer, and can be used in any department upon request within the system.

What other documents need to be submitted to the FIU along with the SPV-2 form?

FROM AUTHENTIC SOURCES

“ Form SPV-2 is accompanied by an inventory in the form ADV-6-1 “Inventory of documents transferred by the insured to the FIU” clause 82 of Instruction No. 192p” .

Pension Fund of the Russian Federation

Please note: even if the submission of information to the employee in the SPV-2 form coincides in time with the delivery of the RSV-1 calculation, the SPV-2 form must still be submitted. Also, do not forget to give the employee a copy of the SPV-2 form within 10 calendar days from the date of receipt of an application from him to submit this form. paragraph 4 of Art. 11 of the Law of 01.04.96 No. 27-FZ.

We fill out the SPV-2 form

Information about the policyholder, the insured person, about special working conditions, about the periods during which pension contributions were not paid, is filled in the new form in the same way as in other personalized reporting. But when filling out some lines of this form, the following nuances must be taken into account.

Date of preparation

TELLING THE EMPLOYEE

To The PFR took into account to the maximum the length of service (especially the “harmful”) on the date of the pension, the employee must, during the period of its registration, submit to the employer an application for the submission of the SPV-2 form to the FIU.

It is necessary to indicate the expected date of establishment of the labor pension (dd.mm.yyyy) clause 83 of Instruction No. 192p.

For example, if an employee draws up an old-age labor pension and applies to the FIU for an appointment before reaching retirement age, indicate the date of birth of a person when he reaches retirement age (as a general rule for men - 60 years, for women - 55 years) paragraph 1 of Art. 7 of the Law of December 17, 2001 No. 173-FZ (hereinafter - Law No. 173-FZ). If the employee submitted an application for a pension to the FIU after the birthday, then this will be the date of submission of the application to the FIU pp. 1, 2 art. 19 of Law No. 173-FZ.

Reporting period, insurance period, fact of accrual of contributions

How to correctly indicate these data in the SPV-2 form, we were explained to the branch of the Pension Fund of the Russian Federation for Moscow and the Moscow Region.

From reputable sources

“Reporting periods are the first quarter, half a year, 9 months of a calendar year, a calendar year, which are designated as “3”, “6”, “9” and “0”, respectively.

When filling in the requisite “Work period for the last 3 months of the reporting period”, as the start date of the period (from dd.mm.yyyy), you must specify the day following the end day of the reporting period (quarter) preceding the reporting period (quarter) in which estimated date of establishment of the labor pension. And as the end date of the period (according to dd.mm.yyyy), you should indicate the expected date for establishing the labor pension and clause 83 of Instruction No. 192p.

If, before the expected date of awarding the pension, the insured has not yet submitted individual information to the FIU for the previous reporting period (quarter), then form SPV-2 must be submitted for each of the quarters with separate documents.

The fact of accrual of contributions must be reflected if, during the period indicated in the SPV-2 form, the employee had work periods for which contributions to the Pension Fund must be paid, including at an additional rate. In this case, the date of actual accrual of contributions does not matter. The absence of the fact of accrual of contributions is reflected in the SPV-2 form if for the entire period indicated in the form the employee did not have taxable payments (for example, the entire period falls on days of temporary disability) ” .

Pension Fund of the Russian Federation

Thus, if the expected date of granting a pension falls, for example, on September 24, 2014, then the number “9” should be indicated as the code for the reporting period, “07/01/2014” should be indicated as the beginning of the period of work in the reporting period, and - "24.09.2014".

The remaining data on special working conditions affecting the appointment of a pension are indicated using classifier codes a Appendix 1 to Instruction No. 192p.

SPV-2 for entrepreneurs

Entrepreneurs who pay contributions for themselves are also entitled to submit the SPV-2 form to the PFR office at the place of residence for themselves. Some FIU offices refuse to accept this form, arguing that it can only be submitted by policyholders for employees. But in the PFR department for Moscow and the Moscow region, we were told that this was wrong.

FROM AUTHENTIC SOURCES

“ An insured person who independently pays insurance premiums can submit the SPV-2 form to the territorial body of the PFR at the same time as an application for the establishment of a labor pension. Entrepreneurs include only paid contributions in their personal account. Therefore, if an individual entrepreneur pays contributions on a monthly basis, then he is required to accept the form and count the paid period. If the entrepreneur pays contributions at other times (for example, once a year no later than December 31), then the refusal of the PFR body to accept form SPV-2 from him is justified. After all, the periods of activity of persons who independently pay insurance premiums are included in the insurance period only after payment of insurance premiums in Art. 10 of Law No. 173-FZ” .

Pension Fund of the Russian Federation

Consequences of not submitting the SPV-2 form

Here is what the FIU specialist says about this.

FROM AUTHENTIC SOURCES

“ Failure to submit the SPV-2 form by the insured will not entail negative consequences for him. After all, this is a settlement form, not a reporting one, therefore the PFR cannot fine the employer under Art. 17 of the Federal Law of 01.04.96 No. 27-FZ. The PFR can require individual information only at the end of the quarter.

For employees, with the exception of persons entitled to early retirement due to special working conditions, failure to submit the SPV-2 form will also not entail any negative consequences. And for employees engaged in hazardous and (or) dangerous work, the consequences are reduced to the fact that when assigning a pension, periods of special insurance experience will not be taken into account from the day following the day of the end of the reporting period (quarter) preceding the reporting period (quarter), on which the estimated date of establishment of the labor pension falls. And if, without this period, the employee does not have enough experience for the early appointment of a pension, then the PFR will refuse to assign it to him.

Pension Fund of the Russian Federation

The submission of the SPV-2 form does not affect the submission of quarterly individual information for this employee. They must be submitted for the entire reporting period, and not only in the part that was not reflected in the SPV-2 form.

In accordance with federal law, citizens must deal with the registration of their pensions on their own. And every company will sooner or later face the fact that its employee will begin to collect the documents necessary to assign him these payments. If this happens before reporting, then the company will have to provide the employee with a specialized certificate in the form of SPV-2.

This form was approved by the Pension Fund of Russia in connection with a change in pension legislation and began to be applied from August 2019. Prior to this, the SPV-1 form was in effect. In 2019, the SPV-2 form for the Pension Fund has undergone further changes. Now in the form there is no division of the amounts into the accumulative insurance part, but only the insurance period of the employee and whether he received taxable payments is indicated.

Dear readers! The article talks about typical ways to solve legal issues, but each case is individual. If you want to know how solve exactly your problem- contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FOR FREE!

SPV-2 is intended for registration of any pension: for old age, for disability, early retirement. At the same time, it does not matter whether it is concluded with an employee or relations with him are built on the basis of an agreement.

Form SPV-2 is submitted by the company to its branch of the FIU after the employee has written a corresponding application.

Why is it necessary

The need for the SPV-2 form is due to the fact that companies submit information about the length of service and insurance accruals once a quarter, and the start date for the payment of pensions, as a rule, does not coincide with the reporting period. In the absence of information on the accrual of insurance premiums in favor of the employee by the employer for the last 2-3 months, PFR employees may incorrectly calculate the amount of pension payments. The recalculation of these payments after receiving a quarterly report is a rather laborious process.

This form indicates information about the length of service of the employee and the fact of accrual of contributions to the insurance part of the pension without specifying specific amounts.

The insurance period of an employee is the period of his work, during which he was accrued the corresponding contributions. This also includes other periods under federal law when the employee did not actually perform his work, but this time refers to the insurance period. For example, a period of military service, a period of temporary disability, being on parental leave, etc. True, only five years of such periods will be included in the insurance experience.

If an employee works in hazardous conditions that may adversely affect his health, or he works in territories for which a special procedure for calculating insurance premiums has been approved by law, then this information must be indicated in SPV-2.

Basic design questions

Basic document settings

The execution of the SPV-2 form is not laborious, in addition, the Resolution of the PFR No. 473p, which amended it, provides comprehensive instructions for filling it out and a sample form. An employee of the accounting service or personnel department fills out the form, and the head of the company signs it and approves it with a seal.

The following information is indicated in the SPV-2 form:

- Information about the company that is the insurer of the employee, i.e. its name, registration number in the Pension Fund, ;

- This document is the original, corrective or canceling.

- The category code of the employee for whom the form is being filled out.

- Employee data, i.e. his surname, name, patronymic, .

- Form date, i.e. retirement date. This information must match the information provided on the employee's application for the form.

- Code of the reporting period (the certificate is submitted for the last three months, therefore, the code will correspond to a quarter, half a year, 9 months or a year).

- Information about the dates of work of the employee in tabular form. This indicates data on the work of employees for the period that has passed since the last reporting was submitted to the FIU.

New changes in the filing rules

SPV-2, applied in 2019, differs from the previously valid SPV-1 primarily in the absence of a separation of the amounts into the funded and insurance parts of pension contributions. This is due to the fact that the legislation introduced a temporary moratorium on the funded part.

Changes in pension legislation have also been reflected in accounting software. For example, the SPV-2 form can be downloaded in the Kontur program or another similar service. Changes have also been made to 1C for personnel records, allowing you to compile this form automatically, as well as print the completed form for further transfer to the Pension Fund of the Russian Federation.

When and how to hand over paper

Filling out the SPV-2 form must be done at the request of the employee. No additional requests from the Pension Fund are required. If a survivor's pension is issued, the necessary information is provided at the request of the employee's relatives.

There are no mandatory details for the application, so it is compiled by the employee in any form. In this document, it is necessary to indicate for what reasons information about the insurance period is requested, i.e. what type of pension the employee draws up and when the pension payment period begins.

An employee can request data in advance. It is allowed to draw up SPV-2 a month before the expected date. If the date of the form coincides with the submission of the main report to the FIU, then it is still compiled and submitted on time.

The law specifies a ten-day period for submitting the form. However, in case of violation of this period, no penalties are provided for companies. This is due to the fact that this form is not a reporting document, but belongs to the category of reference. A copy of the document is also transferred to the interested employee.

Form SPV-2 for the Pension Fund can be presented traditionally, on paper, or can be transferred using an electronic document management system. If the place of registration of the company and the employee does not match, then the company sends the form to the place of its registration. The document must be submitted along with the inventory in the approved ADV-6-1 form.

If several employees applied to the company with an application to draw up a form, then when transferring them to the Pension Fund, they must be grouped according to the information contained:

- initial data;

- corrective data;

- cancel data.

If employees worked in territories for which different conditions for calculating insurance premiums are provided, then the documents are grouped according to this feature.

Individual entrepreneurs, in accordance with the current legislation, pay insurance premiums for themselves. In this regard, together with the application for the appointment of a pension, they can also submit SPV-2, which they fill out on their own. The form of the form for an individual entrepreneur is no different from the one that companies provide at the request of their employees.

However, the FIU may refuse to accept the form. The reason for this is the fact that insurance premiums are included in the insurance period of an individual entrepreneur only after they are paid, and, as mentioned above, they are paid once a year.

In the SPV-2 form, the company simply indicates whether insurance contributions have been made in the last three months since the last report was submitted to the Pension Fund. To do this, in the tabular part, where this information should be given, columns "Yes / No" are provided. A further breakdown of the deductions should be made by the FIU staff.

The SPV-2 form is supplemented with columns where information should be indicated on whether the employee has accrued additional contributions in connection with work in hazardous industries.

This form is not intended to disclose information on the amount of assessed contributions. Employees of the pension fund learn about this from the quarterly reports of the employing organization.

Completing the SPV-2 form for a pension fund

Form SPV-2 contains details that must be filled out. It is a one-sided document, in the header of which data about the policyholder, the insured person and the document itself are entered. Information about the document is contained in the "Type of information" column.

When filling it out, the officer responsible for submitting this form must put the appropriate sign in one of three lines:

- A check in front of the original form means that the SPV-2 for this employee is issued for the first time, even if it is submitted again after the errors have been corrected.

- A check mark next to the corrective form means that this form changes the previously submitted information about the employee. The corrective form contains the correct data that should have been in the original form, and not the difference between the specified forms.

- A check mark next to the canceling form means that the information submitted earlier is subject to cancellation.

The details of the insured contain the following information:

| Registration number | This line must contain the number of the company that was assigned to it when registering as a payer of insurance premiums. |

| Company name | TIN and checkpoint. |

| Employee category code | This attribute is determined in accordance with the current at the time of filling out the classifier form. |

| Date of preparation | This refers to the date of the pension. The employee must indicate this date in his application for providing information about the insurance period. If a pension is assigned in connection with reaching a certain age, then the employee's birthday is entered here. If he missed this date, then the date of the application. |

| Date of submission to the FIU | This requisite is filled in by an employee of the Pension Fund when accepting the form. |

| Reporting period | This line contains a digital code corresponding to the calendar period. A calendar period is a quarter. The first quarter is code 3, the second is code 6, the third is code 9, and the year is code 0. |

The period of work of the employee for the last three months is filled in in a tabular form. The beginning of the period is counted from the date of the last report submitted to the FIU. For example, if the last report was submitted for the six months of 2019, then in the SPV-2 form, the date 07/01/2016 is put in the column "beginning of the period". And the last date is the date of the pension.

If during the period being filled in there were cases of temporary disability, rotational work, administrative leave, then the corresponding codes are entered in the table. For example, VRNETRUD, WATCH, ADMINISTER, etc. These codes can be found in the Classifier, which is an appendix to the instructions for filling out forms for the Pension Fund of the Russian Federation.

If an employee receives a pension due to working conditions in hazardous production or in certain territories, or the employee is entitled to early retirement, then the corresponding codes are entered in the provided columns of the tabular part.

The tabular part is followed by lines where marks are made in the provided boxes on whether insurance premiums were accrued for the period under review.

Form SPV-2 is signed by the head of the company and certified by the seal of the company. After registration, the document is transferred to the Pension Fund of the Russian Federation along with an inventory in the ADV-6-1 form.

The company does not bear any responsibility for the late submission or non-submission of the SPV-2 form at all, therefore, when collecting documents for applying for a pension, a citizen needs to carefully monitor the correctness of the form on his own. After all, the inaccuracy of data or their absence can lead to an underestimation of the pension or refusal to accrue it.

Attention!

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the site.

- All cases are very individual and depend on many factors. Basic information does not guarantee the solution of your specific problems.

Therefore, FREE expert consultants are working for you around the clock!

- Ask a question via the form (below) or via online chat

Attention! With the publication of the Resolution of the Board of the Pension Fund of the Russian Federation of January 11, 2017 No. 2p, the SPV-2 form became invalid. The resolution entered into force on February 17, 2017. See.

Form SPV-2 was approved to replace the SPV-1 form submitted earlier (until 2014) to the FIU. Filling order forms SPV-2 significantly different from how the previous form was drawn up. Therefore, we recommend that you read this article in order to understand how to draw up and to whom to submit a new settlement document.

SPV-2 - what is it?

Form SPV-2 allows employees of the Pension Fund to find out additional information about the insured for the last 3 months before his retirement. From this document, the FIU will be able to obtain information from the insured in the interreporting period about the insurance experience of the insured person.

The appearance in August 2014 of a new forms SPV-2 contributed to the changes in the Russian pension legislation that came into force. The new form was put into effect by the Resolution of the Board of the Pension Fund of the Russian Federation of July 21, 2014 No. 237p (hereinafter referred to as Resolution No. 237p).

In accordance with the changes that have come into force, now the employer does not divide contributions into the funded and insurance parts, but is obliged to indicate the fact whether there were contributions at an increased rate. The document reflects information about the length of service of the retiring employee and confirms the fact of accrual of insurance premiums made in favor of the insurance part of the pension over the past three months.

All this is reflected in SPV-2 form, which the insured submits to the Pension Fund. Without providing all relevant information until the day of retirement, the future pensioner will receive a lower pension amount, and recalculation after providing additional information will take a lot of time.

What is the procedure for submitting Form SPV-2 for a pension fund?

To receive forms SPV-2 an employee who is going to retire in the near future (labor, seniority, disability or other reasons) applies to the employer for the submission of this document. At the same time, no notification from the FIU is required for the employee to receive this form.

The application is written in free form, its text may be as follows:

“I ask you to submit to the territorial office of the PFR individual information about my length of service and the accrual of insurance premiums for compulsory pension insurance under SPV-2 form in connection with the registration of an old-age pension from July 1, 2016.

The employer must prepare the above document within ten days and submit it to the FIU (paragraph 36 of the order of the Ministry of Health and Social Development of December 14, 2009 No. 987n). And the employee himself can apply for the assignment of pension payments to him a month before the expected retirement date (clause 73 of the order of the Ministry of Labor dated 03/28/2014 No. 157n), which means that the future pensioner can apply to the employer with a request to provide form SPV-2 in advance.

The new form does not contain information on the amount of accrued insurance premiums - these data are displayed in the quarterly reporting in the RSV-1 form. And even if a statement from an employee with a request to submit form SPV-2 arrived just in time for the deadline for compiling and submitting the RSV-1 report, then the document ordered by the employee is still being prepared and submitted to the FIU along with an inventory in the ADV-6-1 form (paragraph 3, clause 7 of the resolution of the FIU Board of July 31, 2006 No. 192p ).

completed form SPV-2 should be signed by the head and certified with the seal of the insurer (paragraph 8, subparagraph 3, paragraph 4 of resolution No. 237p). The form is submitted to the territorial branch of the PF (at the place of registration of the insured) on paper or in electronic form. The employer must also provide the employee with a copy of the said form.

Features of the presentation of the SPV-2 form for individual entrepreneurs

Individual entrepreneurs who independently pay insurance premiums to the Pension Fund for themselves can also submit the SPV-2 form to their PFR branch in relation to themselves. The specified form is submitted to the Pension Fund along with an application for the appointment of a labor pension.

However, it is not uncommon for the PFR to refuse to accept such a form from individual entrepreneurs - this is especially true for those individual entrepreneurs who pay insurance premiums once a year. This is due to the fact that only after payment of contributions, the periods of activity indicated in the report are included in the insurance record of these insured persons.

Responsibility for failure to submit form SPV-2

If the employer does not submit the SPV-2 form to the FIU, then this will not threaten him with any sanctions or other administrative penalties. Responsibility for failure to submit this form is not provided, since this is not a reporting document, but a settlement one.

Non-submission forms SPV-2 the employer bears only negative consequences for the insured himself. After all, if he does not have enough work experience without these last months, which would be indicated in the form, then the employee may be denied a pension. Also, when assigning a pension without a submitted form, the insured person will be credited with a smaller pension, since the last (not included in the quarterly report) periods will not be taken into account.

Help SPV-2 - the procedure for filling out the document

Form SPV-2 filled in according to the same principle as other documents for the provision of personalized information about the insured persons. We are talking about the same procedure for indicating information about the insured himself, the insured, the presence of special working conditions, periods for which contributions were not paid.

It is important to indicate the expected date of the employee’s retirement - upon retirement by age, this will be the day when a man turns 60 and a woman turns 55 (or earlier in accordance with Article 27 of Law No. 173-FZ of 17.12. legislation). If an employee was late in submitting an application for a pension, i.e., he did it after his birthday, then SPV-2 indicates the date when this application was submitted to the Pension Fund.

The insured should accurately indicate his reporting period - it can be a quarter (3), half a year (6), 9 months (9) or a year (0). For example, if the expected date for the appointment of a pension is September, then the reporting period code will be 9.

When the tabular part of the document is filled in the column “Work period for the last three months”, then in the field with the start date of the period, you should indicate the number that was the first after the end of the previous reporting period. For example, if the report was given in March, and the SPV-2 form is filled out in May, then the beginning of the period will be April 1.

In the field with the end date of the period, the day when the pension is supposed to be established for the insured person is indicated. If it is necessary to submit individual information on the insured for a period exceeding 3 months (when reports are submitted less than once a quarter), then it will be necessary to fill out several forms of the SPV-2 form indicating information for every 3 months before the expected date of assignment of labor pension.

AT SPV-2 form the code designations specified in the classifier approved by Decree No. 192p and supplemented by Decree No. 237p are used. These codes are used to indicate special periods, for example, to indicate the time of illness (VRNETRUD), administrative leave (ADMINISTER), downtime due to the fault of the enterprise (SIMPLE) and other situations.

Where can I download a completed sample of filling out the SPV-2 form?

In order to avoid confusion with filling out the SPV-2 form, we recommend that you familiarize yourself with the completed example of this settlement document. For reference SPV-2 sample you can download it on our website.

Results

In order for the insured person, when assigning a labor pension, to count all periods of insurance experience, when the deadline for submitting mandatory reporting by the employer to the FIU has not yet come, you should worry about compiling forms SPV-2. In order for this settlement document to be submitted by the insured to the FIU, the insured person who is about to retire must submit a corresponding application to the employer.

The reporting campaign for personalized accounting information for the 1st half of 2010 has ended, the next time we will submit individual information to the FIU only in January 2011. However, even before this time, it may be necessary to provide the FIU with information on the insurance period and contributions of employees: information for establishing a labor pension or corrective reporting information in case of errors. E.A. tells how to prepare such information in payroll solutions on the 1C:Enterprise 8 platform using the example of the Payroll and Human Resources configuration. Gryanina, independent consultant.

.

Preparation of data for the FIU.

- Purpose into position Registration of pension (SPV);

- in the table field Future pensioners

- click on the button Generate information.

Rice. one

Information on contributions and insurance experience SPV-1 Stacks of documents.

Preparation of data for the FIU Stacks of documents Pack composition

Preparation of data for the FIU Seal File to disk

Information on contributions and insurance experience SPV-1 Stacks of documents

Preparation of data for the FIU

Note:

Note./document-1649 .

Preparation of information for establishing a labor pension (form SPV-1)

Information for establishing a labor pension is submitted to the territorial body of the PFR by the insured (employer) at the request of the insured person, who has the conditions for establishing a labor pension. Information must be submitted within 10 days from the date of the insured person's application (clause 36 of the Instruction on the procedure for maintaining individual (personalized) records of information about insured persons, approved by order of the Ministry of Health and Social Development of Russia dated December 14, 2009 No. 987n, hereinafter referred to as the Instruction).

Starting from 2010, the submission of individual information for establishing a labor pension is carried out in the form of SPV-1 "Information on the accrued, paid insurance premiums for compulsory pension insurance and the length of service of the insured person for establishing a labor pension." Form SPV-1 is included in the list of personalized accounting forms by the Resolution of the Board of the Pension Fund of the Russian Federation dated 06/23/2010 No. 152p.

The rules for filling out the details of the SPV-1 form are generally similar to the rules used for reporting individual information SZV-6. The main difference is that reporting information is generated for the entire reporting period (in 2010 - this is the first and second half of the year), and information for establishing a pension - from the beginning of the reporting period in which the employee retires to the expected date for establishing a labor pension . This applies to both seniority records and contributions.

Consider the procedure for filling out the SPV-1 form when preparing it in the program "1C: Salary and personnel management 8". Information in the SPV-1 form is generated using a document Information on contributions and insurance experience SPV-1.

In the program "1C: Salary and personnel management", starting from release 2.5.27, for the preparation of individual information, including the SPV-1 form and the automated creation of relevant documents in the information base, you can use the processing tool Preparation of data for the FIU.

To prepare information for the assignment of a labor pension in the processing form, it is necessary (see Fig. 1):

- indicate the organization in the header of the form, select the reporting period for which the estimated date of establishing the labor pension falls, and set the radio button Purpose into position Registration of pension (SPV);

- in the table field Future pensioners indicate the employee for whom it is necessary to submit information for establishing a labor pension (or, if there are several such employees, then a list of employees), and the expected date for establishing a labor pension;

- click on the button Generate information.

Rice. one

This will automatically generate one or more documents. Information on contributions and insurance experience SPV-1, containing individual information on the employee. Generated documents will be reflected in the list Stacks of documents.

Information can be viewed and, if necessary, edited directly in the processing form Preparation of data for the FIU. When a document is selected in the list Stacks of documents the form reflects all the information contained in this document, the type of information, the pack number, the category of insured persons, in the table field Pack composition- a list of employees for whom information has been prepared. When an employee is selected in the list in the lower right part of the form, data on this employee is displayed: information on the amount of contributions to the insurance and funded part of the pension, records of length of service. All this information can be edited in the processing form; when saving the information, it will be automatically written to the corresponding infobase documents.

According to the prepared information from the processing form Preparation of data for the FIU it is possible to generate and print the SPV-1 forms and the ADV-6-3 inventory accompanying them. This action is performed using the button Seal. Uploading files for transfer to the FIU is done using the button File to disk. Note that the pension form SPV-1 is not accompanied by a list of information in the ADV-6-2 form. Before generating printed forms and files, the information is checked for errors. If there are errors, the printed form/file is not generated and the user is presented with an error message. The error should be corrected and printing/uploading should be repeated.

After the transfer of information to the FIU, the document Information on contributions and insurance experience SPV-1 should be carried out. To do this, you can use the button located on the command panel of the list. Stacks of documents. When posting a document, a copy of the batch file corresponding to it is stored in the information register Regulated reporting data archive and editing the document is prohibited. Consider some points that you should pay attention to when preparing information on the SPV-1 form.

1) A package of information in the SPV-1 form may contain information for only one category of insured persons. If insurance premiums for an employee who is assigned a pension were paid at different rates *, then several SPV-1 documents must be prepared for him. When automatically generating information using processing Preparation of data for the FIU a separate document will be created for each category of the insured person corresponding to the applied type of tariffs.

Note:

* For example, insurance premiums from payments in favor of employees of an organization that applies the general taxation system and pays UTII for certain types of activities are charged: for activities subject to UTII - at reduced rates, and for non-taxable UTII activities - at regular rates. Contributions from payments in favor of a disabled employee of a "regular" organization, whose disability was established in the middle of the reporting period, are accrued: before the establishment of disability - at regular rates, and after the establishment of disability - at reduced rates.

2) According to the rules for filling out the details of the SPV-1 form, the dates of records of seniority must be within the period from the day following the end of the reporting period preceding the reporting period, which is the expected date of establishing a labor pension, to the expected date of establishing a labor pension. In other words, from the beginning of the reporting period to the date the labor pension was established. For example, the date of establishing a labor pension is 09/20/2010, information about the length of service must be entered for the period from 07/01/2010 to 09/20/2010.

The rules for entering information about the length of service and the algorithm for their automated filling are similar to the rules that apply when preparing reporting information according to the SZV-6 forms. Just as in the reporting information, periods of temporary disability, leave without pay are separately allocated, details of information related to preferential pension provision are filled in.

Note. The rules for filling in information about the insurance period are discussed in detail in the article "Preparation of personalized accounting information for the first half of 2010 in salary decisions on the 1C:Enterprise 8 platform" - /document-1649.

3) Information on accrued and paid insurance premiums is filled in in accordance with the rules for filling out the details of the SPV-1 form:

- in the details Accrued - indicates the amount of accrued insurance premiums for the insurance / funded part of the labor pension for the period from the day following the day of the end of the reporting period preceding the reporting period, which falls on the expected date of establishment of the labor pension, to the expected date of establishment of the labor pension, in rubles and pennies;

- in the details Paid - indicates the amount of paid insurance premiums for the insurance / funded part of the labor pension in the period from the day following the day of the end of the reporting period preceding the reporting period, which accounts for the expected date of establishment of the labor pension, to the expected date of establishment of the labor pension, in rubles and pennies.

Note that in practice, the rules for filling in information about the amounts of contributions may raise questions. For example, if the date of establishing a labor pension falls on the first days of the month, when the salary and contributions for the previous month have not yet been calculated. In this case, should SPV-1 reflect only the amounts of contributions accrued for previous months, or is it necessary to pre-calculate for the last month and take into account the amount of this month's contributions?

Difficulties may also arise due to the fact that the actual date of preparation of the information does not coincide with the expected date of establishment of the pension. It is possible that, on the date of preparation of the information, the payment of contributions has not yet actually been made, however, it is clear that the contributions will be paid on the date the pension is established. Should these contributions be reflected in the program and accounted for?

The instructions for filling out the SPV-1 form do not contain answers to these questions. Regional branches of the pension fund give the following explanations on filling in the columns "Amount of insurance premiums for the insurance part of labor pension" and "Amount of insurance premiums for the funded part of labor pension" of form SPV-1 (in particular, the branch for the Republic of Komi in the Memo to the insured on reporting for 1st half of 2010, posted on the website of the PFR branch):

- in the details "Accrued" - the amount of accrued insurance premiums should be reflected as of the end of the month preceding the expected date of establishing a labor pension for the insured person;

- in the details "Paid" - the amount of paid insurance premiums should be reflected on the expected date of establishing a labor pension for the insured person. The amounts of overpaid insurance premiums are not taken into account.

It is also clarified that the amounts of insurance premiums that were not accounted for for any reason on the personal account of the insured person at the time of the appointment of a pension will be taken into account during the subsequent recalculation of the specified pension (12 months after the appointment) or when adjusting the pension.

Thus, when filling out information about the amount of contributions, one should proceed from the fact that the SPV-1 form is designed to be able to take into account insurance premiums for the inter-reporting period when assigning a pension to an employee, and what amounts of contributions will be indicated in the form, such will be taken into account when assigning a pension. At the end of the reporting period, the FIU will be provided with "complete" individual information on this employee, on the basis of which information on the amount of contributions will be clarified. However, it should be noted that the amount of accrued insurance premiums in the reporting information cannot be less than the amount indicated in the SPV-1 form. If such a discrepancy is revealed, then the employer will need to submit a corrective form SPV-1.

Preparation of corrective individual information

Corrective individual information is submitted to the PFR authorities in case of detection of errors or inaccuracies in previously submitted information.

To change previously submitted individual information, corrective information is submitted to the Pension Fund of the Russian Federation, for the complete cancellation of previously submitted information - canceling information. Note that if individual information is not accepted by the territorial body of the PFR due to errors in the submitted documents, then in this case, corrected forms should be submitted with the type of information "initial" and indicating reliable data.

Thus, if the submitted original form was returned to the employer due to errors contained in it, then the original form is also submitted instead. Corrective forms are filled out if false information was previously provided, then the adjustment completely replaces the original information. The cancellation form is submitted if it is necessary to completely cancel the data submitted earlier.

Correcting individual data for the first half of 2010 and for the following reporting periods are submitted using the new forms SZV-6-1, SZV-6-2, ADV-6-2, ADV-6-3. To correct information for previous periods (2002-2009), old forms SZV-4-1, SZV-4-2, ADV-11 are submitted, i.e., the same ones for which erroneous reporting was submitted.

Let's consider how corrective individual information is formed in "salary" solutions on the 1C:Enterprise 8 platform.

Before preparing corrective information in the program, it is recommended to make sure that the previously submitted information is recorded in the infobase, i.e. that documents and Inventory of information ADV-6-2 (until 2010 - Statement of payment ADV-11), with the help of which the initial information was prepared, were carried out. If for some reason these documents are not carried out, then they should be carried out. When conducting documents, copies of the submitted information are stored in a specialized information register Regulated reporting data archive.

When generating printed forms or files in electronic form for the posted personalized accounting documents, the data of this particular register is used. Thus, the user always has the opportunity to see exactly what data was transferred. Additionally, it is recommended to protect source documents from accidental reposting with the flag Accepted by the FIU.

After that, you can correct the credentials. It all depends on what type of error or inaccuracy was found in the original information.

If this is an inaccuracy in the records of seniority associated with an error made during record keeping, for example, when registering a personnel event, the date of admission or dismissal was incorrectly indicated, or an event was forgotten to be reflected in the information base, for example, leave without pay, or not correctly indicated the code of special working conditions in the staffing table, etc., which led to an error in individual information, then the error in the credentials should be corrected: correct the date in the personnel document, register leave without pay, indicate the correct code of special working conditions in the staff list, etc.

If this is an inaccuracy due to the fact that some information became known only after the submission of information, for example, in the current period, the employee submitted a sick leave relating to the previous reporting period, then the data in the information base must be clarified, in particular, register a period of temporary employee disability.

If an error is found in the calculation of insurance premiums for compulsory pension insurance, then it is necessary to perform their additional accrual or recalculation. In this case, corrective personalized accounting information may have to be submitted along with an updated calculation of accrued and paid insurance premiums in the RSV-1 form.

Note that the obligation to submit an updated calculation in the RSV-1 form arises from the employer if errors are found that lead to an underestimation of the amount of insurance premiums (Article Federal Law of July 24, 2009 No. 212-FZ). If errors are found that do not lead to an underestimation of the amount of insurance premiums, the payer of insurance premiums has the right to submit an updated calculation, but may not do so.

It should also be noted that, according to the clarifications of the Ministry of Health and Social Development of Russia (letter No. 1376-19 dated May 28, 2010), it is not required to submit an updated calculation in cases where in the current period the employer has discovered the need to withhold payments from the employee that were excessively accrued in previous reporting (calculated) periods or if the employee in the current reporting (settlement) period receives additional payments for previous periods. These cases do not reveal an error in the calculation of the base for calculating insurance premiums, since in each of the indicated periods (past and current) the base for calculating insurance premiums was determined as the amount of payments and other remunerations accrued in favor of employees in that particular period. Based on this, we can conclude that corrective individual information in these cases does not need to be submitted. However, in practice, a situation may arise when, due to the reversal of accruals from previous periods, the basis for accruing contributions for an employee in the current period turns out to be negative. The PFR will most likely not accept reports with a negative amount of assessed contributions, therefore, in this case, it will apparently still be necessary to submit corrective information for the previous period.

There is another nuance associated with the detection of errors in the amount of accrued insurance premiums. If an error is found in the amount of contributions for any employee, then corrective information in this case may have to be submitted for all employees. This is due to the fact that the contributions paid for each employee are calculated by distributing the total amount paid in proportion to the amounts of contributions accrued for each employee, therefore, a change in the amount of contributions accrued for one employee will lead to a change in the payment coefficient and the amount of contributions paid for all employees.

After putting the credentials in order, you can begin to generate corrective information. In the program "1C: Salary and personnel management 8" for this, you can use the processing tool Preparation of data for the FIU. In the case of preparation of corrective information, documents SZV-6, ADV-6-2 are added to the list Documents, stacks of documents manually (using the button Add) - see fig. 2.

Rice. 2

Information on forms SZV-6-1, SZV-6-2 is formed using the document Information on insurance premiums and length of service of insured persons (SZV-4, SZV-6) (Add -> SZV-6).

To prepare corrective information switch Information type should be set to Corrective, if necessary, submit canceling information - to the regulation canceling.

Please note that according to the new rules, when submitting corrective (cancelling) information in the details Reporting period you must specify the reporting period in which the information is submitted. In particular, when submitting corrective information in the second half of 2010 for the first half of 2010 in the details Reporting period a period should be set 2010.

In props Adjustable period you must specify the reporting period for which the information is adjusted.

For example, when submitting corrective information in the second half of 2010 for the first half of 2010 in the details Adjustable period a period should be set 1st half of 2010.

Next, you need to select the type of form: SZV-6-1 or SZV-6-2, indicate the category of insured persons to which the information relates. In the table field Composition of the pack, you must enter a list of employees for whom you want to clarify information.

Note that if it is necessary to submit corrective information for all employees, it is more convenient to enter documents with corrective information by copying the original documents Information on insurance premiums and length of service of insured persons (SZV-4, SZV-6), and then change their information type.

The preparation of the canceling form ends here. In the corrective information, it is necessary to indicate the new correct data on the length of service of employees and the amount of accrued and paid contributions to the insurance and funded part of the pension. This information can be filled in automatically based on the infobase data. It should be borne in mind that the information in the corrective form is indicated in full, and not only corrected, since the information in the corrective form completely replaces the information in the original form.

Information about the amount of contributions can be filled in automatically by clicking the button Calculate contributions. Please note that there are additional details for corrective information. Including additional accrued, which are not in the original data. These details indicate the amounts of additional accrued insurance premiums for the reporting period for the insurance and funded parts of the pension, if additional assessment of contributions has taken place.

This data is only used for output in the section Information about corrective (cancelling) information inventories of information in the form ADV-6-2 accompanying bundles of documents SZV-6-1 and registers of corrective information SZV-6-2: the section displays the total amounts of additionally assessed contributions.

To refill records of seniority according to the infobase data, use the button Refill table field command bar Periods of work for the reporting period.

To prepare an inventory of information in the ADV-6-2 form, a document is used Description of information ADV-6-2 (Add -> ADV-6-2). The inventory includes previously prepared SZV-6 documents.

Example

To prepare corrective information in the processing form Preparation of data for the FIU 2010 is indicated as the reporting period. In the table field D documents, stacks of documents the ADV-6-2 document is added manually, and the SZV-6 document is added to the ADV-6-2.

Document SZV-6 (Information on insurance premiums and length of service of insured persons (SZV-4, SZV-6)) specify the type of information Corrective, the 1st half of 2010 is chosen as the adjustment period. Add to list Pack composition a line is added and an employee is selected for which information must be submitted.

Then, reliable data on the amounts of accrued and paid contributions for the employee are entered. To fill in the information according to the infobase data, use the button Calculate contributions. Suppose that the absence of an employee in June was registered as a failure to appear for an unexplained reason, she was not paid for this period, respectively, the insurance premiums were calculated correctly and do not need to be adjusted. The corrective information will then contain the same contribution amounts that were indicated in the original individual information of the employee.

Next, the correct seniority records for the employee are entered. If the period of temporary incapacity for work of an employee is registered in the information base (using the document Sick leave accrual), then new information about the experience can be generated automatically by clicking the button Refill.

Information prepared in this way remains to be printed and / or uploaded for transmission to the FIU in electronic form.

After the transfer of information to the FIU, documents Information on insurance premiums and length of service of insured persons (SZV-4, SZV-6) containing corrective information, and Description of information ADV-6-2 should be carried out.

From the editor. The procedure for preparing information described in the article is available starting from version: 2.5.27 of the Payroll and Human Resources configuration; 1.0.16 configuration "Salary and personnel of a budgetary institution".