Permission to produce beer per year. Beer Law: Recent Changes

Do I need online cash desks for individual entrepreneurs selling beer

According to 54-FZ (as amended on 07/03/2016), organizations and individual entrepreneurs on UTII (which are the majority of entrepreneurs in this business) are required to use online cash desks only from 07/01/2018.The contradiction of laws allows the principle of priority of a special norm over the main one. In this situation, the requirements of Law 261 take precedence over Law 54.

Thus, by March 31, 2017, absolutely all sellers of draft beer, including individual entrepreneurs on UTII, must purchase an online cash register and conclude an agreement with a fiscal data operator (OFD).

What equipment and software is needed to sell draft beer in 2017

Following the letter of the law, in 2017 draft beer shops must have at their disposal an online cash register and a technical solution for working with EGAIS.

To connect to EGAIS, you need to have any computer available and purchase: a JaCarta crypto key, as well as a program compatible with EGAIS that will exchange data with UTM (universal transport module). How to do this, we already wrote in the article.

How to choose a cash desk, we examined in detail in the article

How to minimize the cost of equipment for the sale of beer

Today, the best solution is to use a fiscal registrar as an online cash desk. It will not only send data to the OFD, but also interact with EGAIS, making up a single software and hardware complex with a computer. At the same time, all the necessary software and a crypto-key must be installed on the computer.For small and medium-sized businesses, it is advisable to use an automation Internet service as a program for exchanging data with UTM. This is the most profitable and effective, because. no costs for the purchase and configuration of software. In addition to the standard functionality for working with EGAIS, such a service ( online program) can fully automate the business, reducing costs and increasing profits.

For example, the Subtotal online program not only fully supports EGAIS and FZ-54 (online cash desks), but also provides a full-fledged opportunity. Subtotal allows you to keep track of sales, inventory, includes management control tools, financial reports and much more. Learn more about the features of the program

Beer trade is a special type of entrepreneurial activity, which is subject to certain requirements from the regulatory authorities. Violation of the legislation regulating the circulation of products containing alcohol is fraught with the imposition of fines and other penalties on the entrepreneur, up to the closure of the outlet. What do you need to know in order to trade beer as an individual entrepreneur, and what are the restrictions set by the legislator in this area?

Requirements for running a beer trading business

According to the current legislation, a business selling beer by an entrepreneur must meet the following requirements:

- retail sale of beer must be carried out exclusively in stationary buildings and premises registered as the property of any person. It is prohibited to sell beer drinks in temporary structures. However, there is one exception to this rule - in the event that an institution will operate in a temporary structure Catering(for example, a cafe or bar), among other services, offering visitors the sale of beer, it will not be a violation of the law to conduct such a business;

- the sale of beer can be carried out by an individual entrepreneur or an organization registered in the form of a limited liability company or an open joint stock company.

IP reporting to EGAIS

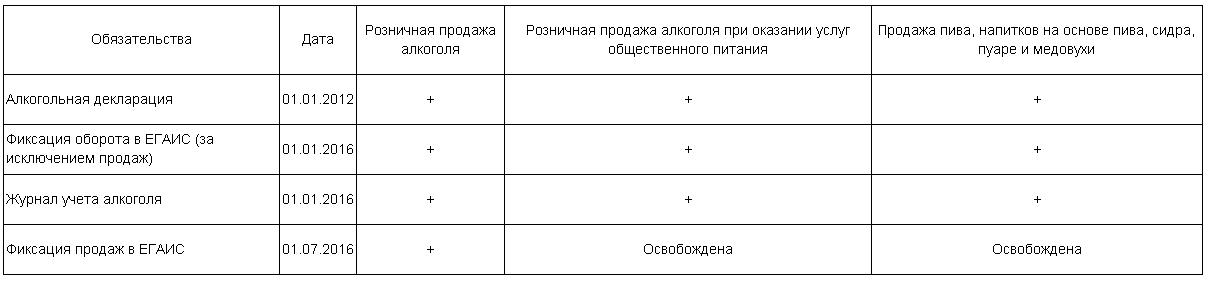

On January 1, 2016, a number of provisions of the letter No. 17788/15-02 issued by Rosalkogolregulirovanie came into force. According to its provisions, all individual entrepreneurs will be required to submit to EGAIS (unified state automated information system for recording the volume of production and turnover ethyl alcohol, alcoholic and alcohol-containing products) information on the volume of purchases of alcohol, including beer products (it is not required to report on sales volumes). Order.

Restrictions on the retail sale of beer by individual entrepreneurs

When opening a business for the sale of beer products, you should familiarize yourself with the restrictions established by law, according to which this type of trade is not allowed to be carried out:

When opening a business for the sale of beer products, you should familiarize yourself with the restrictions established by law, according to which this type of trade is not allowed to be carried out:

- in children's, educational and medical institutions, as well as in the territories adjacent to them;

- in organizations working in the field of culture (with the exception of cases in which the entrepreneur, in addition to selling beer, provides public catering services to the population);

- v public transport any type (urban, suburban and intercity railway), as well as at gas stations;

- at railway stations, airports (with the exception of duty-free shops), markets and other crowded places;

- at military installations and territories adjacent to them;

- minors. At the same time, the seller, if he has any doubts about the age of the buyer, has the right to demand from him an identity document and confirming the fact that he has reached the age of majority;

- during the period from 22 00 pm to 10 00 am.

List of accompanying documentation for beer products

An individual entrepreneur is required to have a package of documentation that is mandatory when trading beer. To such documents, according to paragraph 1 of Art. 10.2 of the Federal Law No. 171 dated November 22, 1995, apply:

- commercial and transport waybill, as well as the certificate attached to it;

- a copy of the notice of payment of the advance payment of excise, certified by the signature of the individual entrepreneur and his seal (if any).

According to paragraph 2 of Art. 14.6 of the Code of Administrative Offenses of the Russian Federation, the absence of documents from the entrepreneur certifying the legality of the sold beer products entails the imposition of an administrative fine in the amount of 10 to 15 thousand rubles, followed by its confiscation.

So, an individual entrepreneur carrying out retail trade in beer must comply with a number of legislative requirements. In particular, he must have all Required documents, confirming the legality of the production of sold beer products, as well as to engage in sales in stationary premises located in designated places. In addition, from January 1, 2016, all individual entrepreneurs selling beer must report to the Unified State Automated Information System on the volume of purchases of products subject to retail sale.

From the summer of 2017, the deputies plan to introduce a ban on the sale of IP beer. The Ministry of Finance has already prepared a bill prohibiting private traders from selling foamy drink, cider, booze and mead. Only legal entities will be allowed to sell them to the end consumer.

Let's hit the beer!

From July 1, 2017, new rules for the sale of beer may come into force in Russia - only legal entities, and this, moreover, that this moment 90% out of 90,000 retail outlets selling foamy drink are registered specifically for individual entrepreneurs. On the territory of Crimea and Sevastopol, the new norms may come into effect from January 2018.

Retail trade in IP beer in 2017 may be limited for one reason. As the authors of the bill explained, small businessmen are very actively hiding the real volumes of sales, including because too loyal fines are provided for violations:

if a legal entity can pay a fine of 150-200 thousand rubles for failure to provide a declaration,

then IP - only 10-15 thousand.

V explanatory note The bill contains statistics that confirms that in 2015 some breweries declared many times less products than were sold at retail.

The current law on the sale of beer for individual entrepreneurs and enterprises of other forms of ownership obliges, since July 2016, regardless of the form of ownership, organizations selling beer to provide sales data to the Unified State Automated Information System, so many businessmen consider additional declaration to be a waste of time and effort. The deputies do not agree, so they want to tighten the implementation rules and introduce another type of labeling for alcoholic beverages to the planned ban for individual entrepreneurs. The corresponding draft law has already been posted on the portal of legal acts for public discussion.

Experts fear that innovations will hit hardest on enterprises that specialize exclusively in the sale of weak alcoholic beverages, including breweries producing "live" beer in small volumes. In addition, the traditional schemes that Russian entrepreneurs use in cases of bans are not ruled out - most simply go into the shadows, as a result of which arrears to the budget increase.

Alcohol online

Sociological research of RANEPA, Rosstat and the Institute social analysis and forecasting showed that last years in Russia, there has been a trend of shifting the preferences of Russians - against the backdrop of a growing rejection of alcohol, people more often choose not strong drinks (vodka, cognac), but beer or wine.

Statistics. In 2007-2009 Russians consumed 32% of beer from total alcohol retail sales. In 2015 - already 43%.

Experts are convinced that even if “the nuts are tightened too much” and it becomes difficult to buy beer in a regular store, there will always be an opportunity to get what you need in another way. For example, via the Internet, because it's no secret to anyone that even with the current ban on the sale of alcohol at night, you can buy it online at any time, in any quantity and with home delivery.

Trying to restore order in this area, deputies propose to legalize the sale of alcohol online by sale of a special license, which will give the right to both individual entrepreneurs and legal entities to legally sell alcoholic beverages via the Internet. To do this, you need to buy:

license for retail trade (preliminary cost of 80 thousand per year);

license for wholesale trade (800 thousand rubles / year);

patent for the production of alcohol - 9.5 million rubles.

Stores with licenses will be included in a special register. The rest will be identified, punished, closed. How this will look in practice is still unknown, although judging by the actions of casinos and other resources whose activities are limited in Russia, it is not difficult to recreate the picture. Today one illegal store is closing, tomorrow two new ones will open in its place.

Time will tell whether the sale of IP beer will be banned in the midst of the next season or not. Ordinary consumers can only hope that innovations in Once again won't show up in their wallet.

FSRAR provided individual entrepreneurs with only one product option for sale - low-alcohol drinks. That is, the assortment of a retail outlet that sells at retail consists of poiret, mead, as well as beer and drinks prepared on its basis. The right to sell strong alcohol can only be obtained by a legal entity.

New rules for cooperation between the seller and EGAIS

In 2017, participants in the beer business undertake to confirm the purchase of alcoholic products on the Internet by sending data to the service that regulates the activities of participants alcohol market- RosAlkogolRegulation (RAR). Therefore, having constant access to the Internet required condition for all individual entrepreneurs who are engaged in the retail sale of beer, if the businessman does not submit a report to the state - according to No. 182-FZ, he commits an illegal sale of alcoholic products.

The above federal law and No. 171-FZ contain detailed information on the timing of connection to the Unified State Automated Information System for individual entrepreneurs who sell alcoholic products in urban or rural settlements, as well as for retail outlets in the Crimea or Sevastopol. Starting from July 2016, in addition to recording information about the purchase of alcohol, the seller sends data on the results of the alcohol trade to the system, but individual entrepreneurs selling beer are an exception.

If a businessman decides to engage in the retail sale of alcoholic beverages, then he needs to study the “Register” subsection on the official website of the Unified State Automated Information System in order to familiarize himself with important information:

- Accounting different types alcoholic beverages and the conditions for testing this product before it is bought by customers of retail outlets;

- Standards for alcoholic products suitable for retail sale;

- In what volume and quantity it is allowed to sell alcohol to retail outlets.

In 2017, a number of innovations took place, which primarily affected individual entrepreneurs and catering establishments, namely their activities - the retail sale of beer. Now it is forbidden to sell alcoholic products remotely, and drinks purchased in public catering are allowed to be consumed only where they were purchased.

State permit for the sale of draft beer

The Law on the sale of beer regulates the sale and manufacture of beer products on the territory of the Russian Federation and abroad. Since January 1, 2017, the law on beer has undergone significant adjustments. In particular, they relate to places where beer is sold, licensed and new packaging. The draft beer law applies to both wholesale and retail trade. Now, individual entrepreneurs selling beer must register with the Unified State Automated Information System.

Description of the law

The federal law on the sale and circulation of alcoholic products, ethyl alcohol and alcohol-containing preparations came into force in November 1995. The law includes four chapters and twenty-seven articles. It regulates the turnover and production on the territory of the Russian Federation of alcohol and products containing alcohol. The last amendments were made to the law on July 3, 2016, and come into force on July 1, 2017. Summary Federal Law No. 171-FZ of November 22, 1995 on State regulation of the production and circulation of ethyl alcohol, alcoholic and alcohol-containing products:

- First section - installs general provisions laws and powers of state authorities in the sphere of production and commodity turnover;

- The second section regulates the requirements for manufactured products and trade turnover on the territory of the Russian Federation and abroad;

- The third section establishes the licensing procedure for the production of alcoholic and alcohol-containing products;

- The fourth section establishes control and responsibility for non-compliance with the norms of Federal Law -171.

Download

The provisions of the Federal Law on the state regulation of the production and circulation of ethyl alcohol, alcoholic and alcohol-containing products provide information on the procedure for the sale and production of alcohol and products containing ethyl alcohol.

Updated FZ-171 can be downloaded

Last changes

Since January 1, 2017, the law on beer has undergone significant changes in Article 11, Article 6.1 of the Federal Law and in Article 16. In particular, they relate to the veto on the production and circulation of alcohol in plastic packages with a volume of more than 1.5 liters.

From July 1 of this year, the change applies not only to wholesalers, but also to retailers, which is indicated in Article 16, paragraph 15 and paragraph 2. FZ - 171. How to trade beer under the new law?

According to the new amendments, article 16 of FZ-171 establishes a ban on the sale of beer products in the following territories and facilities:

- Medical institutions, schools, kindergartens, universities;

- Objects of cultural and sports purposes;

- In public transport and at stops for transport;

- Fields large cluster people - markets, railway stations, airports, except for catering points;

- Military and strategic facilities.

Beer is allowed to be sold in official retail outlets of a stationary type, included in the USRN. Under the new amendments, it is forbidden to sell beer in temporary structures (kiosks, stalls). You can not sell beer remotely. For those trading floors where not only beer, but also other alcoholic products are sold, there is a limitation on the area:

- From fifty sq.m. for cities;

- From 25 sq.m. for villages.

If only beer products are sold, then there is no restriction. Also, the State Duma did not approve a ban on the sale of draft beer in non-residential premises located in MKD, but in some regions such a ban works at the regional level.

The time period for the sale of beer is set between 8 am and 23 pm, except for catering facilities. Under the new law, it is allowed to sell draft beer if the trading facility operates as a catering point, for example, a bar-shop, a summer cafeteria. Thus, it is possible to sell beer in the territories of public and cultural places (theaters, concert halls, etc.), if children do not participate in the events. The same rule works for other objects.

The new provision in article 11 defines the prohibition of production in plastic container if the displacement exceeds one and a half liters. This also applies to wholesale and retail producers of draft beer. Since January of this year, individual entrepreneurs selling beer products are required to register with the Unified State Automated Information System.

Penalties for violating the federal law

For violation of the law, large administrative fines threaten both the director of the company that violated the law and the company itself.