Take out a small loan from a savings bank. Sberbank: minimum loan amount for individuals

In the reliability rating, it is Sberbank that is considered the first bank. It is not surprising that some payroll card holders and others apply here with documents in the first place, without looking back at the conditions. In the history of providing credit loans, refusals are not uncommon, so you need to know how you can get a consumer loan in cash (including, without income certificates, without guarantors, in cash, for a pensioner, under maternal capital, mortgage for the purchase of an apartment, on bail and on other terms). On general conditions a percentage of 14.9% is recited.

How to get a loan from Sberbank - conditions for 2018

To take a certain amount, you need to submit an application through a branch or place an application online for a potential borrower using the link: If you want not to be refused, you need to provide the bank with as many guarantees as possible. In addition, for example, with a guarantee, the interest rate is reduced by about 1%. Holders of salary cards receive the same bonus for consumer lending.

Documents to take out a loan from Sberbank for individuals and pensioners

If you want to take a consumer loan product, then the application must be additionally supported by the following package of documents: passport with registration, document on employment, document on income level. Sberbank has quite a few other special programs. For example, if you use a banking offer for the military, then upon request you need to give the document that confirms that you are serving.

Mortgage loan in Sberbank

Here there is an opportunity to draw up a mortgage agreement. On new buildings, the interest rate starts from 12%, and on finished housing - from 10.75%. Such agreements in Russia can be drawn up for up to thirty years. If you are eligible for state support, then you can even reduce the percentage to 11% for a new building, while a certain part of the initial payment will be paid for you. All in all, customers are required to at least one fifth of the total price with a start-up fee.

Consumer loan at Sberbank

Any goals, no collateral, no surety - these are the advantages that distinguish given view lending. The maximum for this program is one and a half million rubles. In order not to be refused, it is advisable to show a document with information about how much you receive. The consumer loan has a minimum interest rate of 14.9%. The bank takes two days to review your application, and the loan term itself can reach five years.

Cash loan

It will be possible to take out a cash loan without certificates and guarantors at Sberbank in 2018 on fairly favorable terms. Personal consumer goals can be met if you can take an amount from 15,000 to 1,500,000 rubles. No collateral is required for the loan product, and there is no commission for the fact of registration. 14.9% is the percentage that people with a sufficient income level and who have provided the entire package of documents can count on.

How to get a loan from Sberbank so as not to be refused if you have a bad credit history?

This bank looks exactly at the credit history. The only way out is to fix it. This can be done through short-term lending in smaller banks and MFIs. Take there small amounts and extinguish them in as soon as possible... The history will gradually improve and will reach the level that will be sufficient for specialists working at Sberbank. With a bad credit history, it is not advisable to even try to apply, as this may worsen the chances in the future.

Can I get a loan from Sberbank if you don't work?

For consumer lending, six months' work experience at the last job is a mandatory requirement. At the same time, for the cardholders of this bank, this period is reduced to three months. Moreover, employment is a requirement for those who are counting on a mortgage. In addition, the conditions that a banking institution will provide you depend on the level of income.

How to get a loan for a pensioner at Sberbank at a low interest rate?

Since there is no special consumer program here, you just need to complete everything mandatory conditions from the bank. For example, if you are a working pensioner, then prepare a certificate of employment. You can also ask your relatives and friends to become a surety. If either of them agrees, the interest rate will drop from 14.9% to an attractive 13.9%.

How to pay a loan through Sberbank online?

Sberbank of Russia is the largest bank in our country. Over the years of its existence, it has won millions regular customers, improved the quality of service, developed the most acceptable and user-friendly products and services. That is why many are wondering how to get a loan from Sberbank, because it is the most reliable lender in the modern banking market. In fact, the bank offers borrowers a variety of types of lending: targeted and consumer, it remains only to make a choice and consider in more detail all the methods of registration.

First of all, the type of loan depends on the purpose for which it will be issued. What is a loan for, what kind of loan to apply for:

- for the purchase of real estate - a mortgage loan;

- for the purchase of a vehicle - a car loan;

- for household needs - consumer credit;

- spare wallet - credit card.

If a loan is needed for a specific purpose, for example, for education, buying a car or housing, then it is wiser to use targeted loans. First, the interest rate may be lower than on a consumer loan. Secondly, with targeted loans, a surety of third parties or a pledge of the acquired or existing property acts as collateral, which also helps to reduce the cost of the loan.

Also, when applying for a loan, you need to determine:

- loan amount;

- loan terms;

- maximum monthly payment;

- decide on a pledge or surety;

- analyze what certificates and documents you can provide to the bank.

Before taking out a loan from Sberbank, go to the official website and calculate the amount of monthly payments as accurately as possible on a loan calculator.

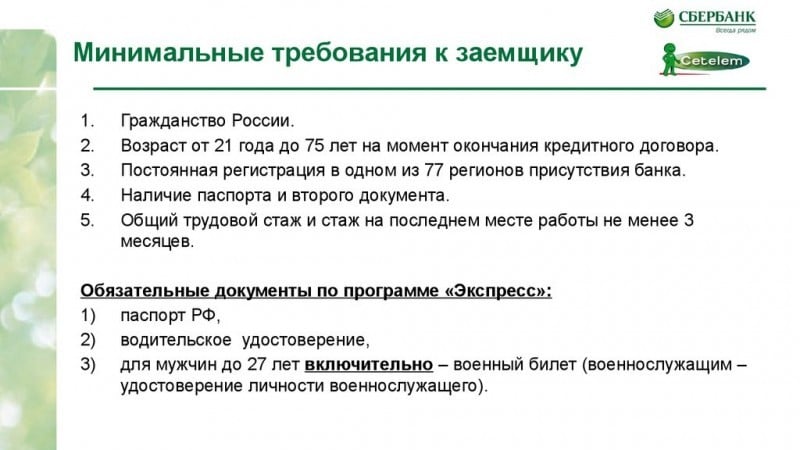

Borrower requirements

As in any bank, the main requirement for a borrower is official employment and regular income. Confirmation of this, the client must have certificate of income in the form of 2-NDFL and a copy of the work book, certified by an employee of the personnel department... Pensioners need a certificate of the amount of pension, it can be taken from the territorial office The Pension Fund... Students also have access to crediting in the form of a credit limit on the youth card of Sberbank, they need a certificate of scholarship payment to confirm their income.

Borrower requirements

An exception is the type of loan for education, the borrower is not required to confirm income, and a teenager aged 14 and older can act as a borrower. But for its registration you will need written permission parents and guardianship and guardianship authorities.

For any type of loan, including mortgage and credit card, the borrower's age must be at least 21 years old at the time of the loan, and not more than 75 years old at the time of full repayment. Do not forget about registration at the place of residence, it must be in the region of applying to the bank.

Depending on the type of loan, the borrower may need guarantors, they can be individuals over 21 years old with a constant source of income that must be documented. The second of the spouses cannot be a surety, because when calculating the total family income, his salary is taken into account.

A decisive role in the issuance of a loan is played by credit history borrower, it must be perfect, otherwise there is a high probability of being rejected.

Lending terms

The main criteria for any loan are:

- interest rate;

- loan terms;

- additional commissions;

As for the interest rate, it depends entirely on the product chosen. For example, a secured consumer loan will be cheaper because the bank has more guarantees to repay the borrowed funds. Therefore, before taking out a loan, the more you need to think about the availability of collateral or the attraction of guarantors.

Loan terms are flexible enough, from 3 to 60 months consumer credit, and up to 20 years on a mortgage... The client can independently choose the loan term, for a start, you only need to calculate the amount of the monthly payment so that the amount is affordable for the budget.

According to the lending agreement, no commission is charged for the consideration of applications, opening a credit account and issuing cash.

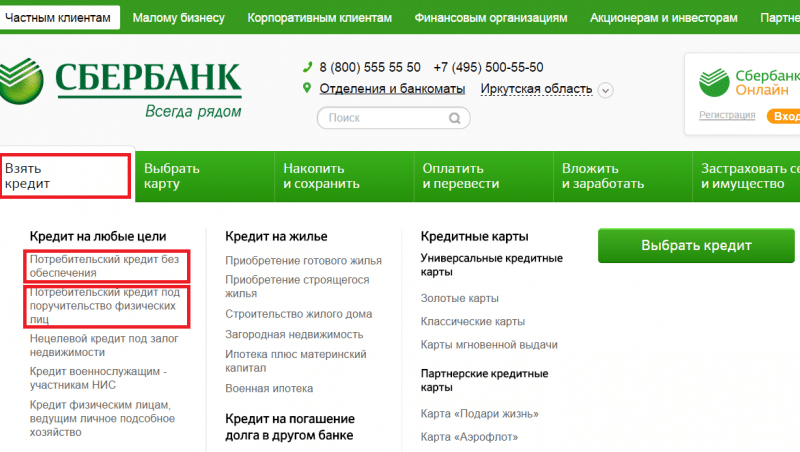

How to get a loan from Sberbank

Obtaining a loan from Sberbank begins with choosing a lending program, after which you can apply, and this can be done in several ways:

- at the nearest branch of the bank;

- fill out a questionnaire on the official website and send it to the bank;

- via Sberbank Online, for bank customers.

At the first visit to the bank, it is enough to provide the loan officer with a passport and an application form, after preliminary approval of the application, you must provide a full package of documents (it depends on the type and conditions of credit). Similarly, you can apply remotely via Sberbank Online:

- go to Personal Area on the official site;

- in the upper left corner, find the link "Take a loan from Sberbank" and open it;

- choose the type of loan you are interested in;

- fill in all the fields and send an application for consideration.

It does not matter how the loan application was sent, the answer can be received via SMS to the contact phone number indicated in the application form.

Usually, it is enough to review the application 2 working days, but the terms can be increased at the discretion of the lender. After receiving a positive answer, you need to collect the entire package of documents and go to the bank branch to sign the loan agreement.

Line of loan products from Sberbank

Salary project participants and contributors

The easiest and most profitable way is to get a loan from Sberbank to holders of deposit accounts, recipients wages, pensions and social benefits to the card of the issuing bank, and there are several reasons for this:

- customers can receive an offer from the bank at any time with favorable conditions for themselves, with

- a certain amount of the loan;

- the interest rate for them is minimal;

- confirmation of income by certificates is not required.

In addition, depositors after the expiration a certain period credit and debit cards are available with free annual service.

All available loan offers can be viewed on the official website of Sberbank, where all the conditions and requirements for borrowers are detailed there. It should be noted that a larger number of clients trusts this credit institution for the reason that it is really guaranteed individual approach to each borrower, regardless of his income and age.

Do you want to take out a loan from Sberbank, but do not know where to start the registration procedure? We will tell you what to do in this case and what offers to choose.

Today in this organization you can find a program for any purpose and for any conditions. This could be:

- consumer credit,

- mortgage ,

- refinancing loan,

- as well as the limit on the card account.

Note that it is not necessary to provide collateral or look for guarantors. You can get a loan on other conditions, you just have to collect more documents and pay a larger%.

Your actions should be as follows:

- First, decide on the type of offer you need. If you need to pay for a purchase, travel, medical treatment, etc., this is a consumer loan. If the purchase or construction of housing is a mortgage. If you want to pay off existing debts in another bank, then this is refinancing.

- After that, you need to go to the site and find the category with lending options at the very top. Select the desired program from the list that appears and click on its name.

- In the new list, choose the most attractive offer for you and carefully read the requirements for the borrower and the documents. If you meet the conditions and can provide the entire list of securities, feel free to contact the nearest branch of Sberbank for a loan

If you want to know how to get a loan without failure? Then follow this link. If you have a bad credit history, and banks refuse you, then you should definitely read this one. If you just want to get a loan on favorable terms, then click

Sberbank is the largest financial institution in the country, providing citizens with borrowed funds for personal needs. Let us clarify which minimum amount a loan in Sberbank in 2017 can be obtained by applying for a private person.

Customer credit

The Any Purpose product line includes programs:

- without security;

- secured by real estate;

- with security in the form of surety;

- for owners of private subsidiary farms;

- for employees of the Armed Forces of the Russian Federation, served under the Military Mortgage program.

Sberbank provides funds for consumer purposes in the amount of 15 thousand rubles. For unsecured and guaranteed loans, the amount depends on the place of issue. In metropolitan offices, you can request at least 45 thousand rubles, 1400 dollars, 1 thousand euros.

Muscovites - salary clients of Sberbank can still receive 15 thousand rubles, but outside the capital: holders of salary cards are guaranteed the opportunity in any branch of the bank within two hours.

The smallest loan to owners of subsidiary farms and employees of the Armed Forces - 15 thousand rubles. An inappropriate loan secured by real estate is from 500 thousand rubles.

Housing loans

Within the framework of mortgage programs, funds are provided for:

- purchase of finished housing from a developer or owner (secondary market);

- the acquisition of building invisibility;

- building your own house;

- purchase of suburban real estate of a summer cottage type.

There is a possibility of using maternity capital (but not for buying summer cottages).

The Military Mortgage program has been implemented for the participants in the savings and mortgage system.

Minimum amount mortgage loan from Sberbank is 300 thousand rubles.

Refinancing issued by other banks has been allocated to an independent category of products. Considering the moderate rate of Sberbank - 13.75% per annum, refinancing is popular, even despite the costs of re-registration (appraisal, insurance) and penalties for early repayment. The minimum amount is 300 thousand rubles.

Sberbank is loyal to borrowers. Interest rates are low, there are benefits for young and large families, salary clients, military personnel. No commission is charged for the issuance of mortgage loans. There are no early repayment penalties.

When the required amount is less than the established limit, it makes sense to take available funds, and the surplus is paid as repayment. The overpayment will be minimal, and the benefit will be significant: the optimal percentage, long term, cooperation with a reliable bank.

Other credit facilities

Sberbank provides a profitable targeted loan for education - at 7.75%. Its maximum amount reaches 100% of the cost of training, the minimum has not been established. It is possible to pay for individual semesters. There are no obstacles to receiving the missing amount for a student who was able to independently pay part of the tuition fee.

Sberbank offers a number of credit cards: classic, Gold class, instant issue, thematic: "Give life", "Aeroflot". What will be the minimum loan in Sberbank within the limit, the client decides for himself. It is profitable to use borrowed funds from cards for payments for goods / services, but it is impractical to withdraw cash: the commission for issuance is 3% of the amount, not less than 390 rubles. The interest for the use of funds is 25.9% per annum and is charged from the day the cash is withdrawn.

Obtaining a loan from a bank - what you need to pay attention to: Video

Due to the fact that Sberbank of Russia carefully checks each potential borrower, refusals to lend are not uncommon. The main verification efforts are aimed at confirming the financial position, checking the history of loans of a potential client, etc. More loyal conditions are provided to holders of salary cards and those who have previously made out loans with Sberbank. However, these facts are not a guarantor of the approval of the application, and does not shorten the list of documents.

Therefore, many potential borrowers ask the question of how to apply for a loan at Sberbank (basic requirements and conditions) so that employees do not refuse to approve the loan and what documents need to be prepared to take consumer or other type of lending. Today we propose to analyze these nuances.

How to get a loan from Sberbank - conditions for 2017

The main requirements of the bank:

Age 21-65;

full package of documents;

good credit history;

documentary evidence of solvency;

experience;

money down payment (other security).

These conditions are the same for holders of salary, credit and other cards and for students and others. Those who want to take a loan at the age of 18-20 have chances of approval only with guarantors, relatives (documents confirming this fact are needed).

Documents to take out a loan from Sberbank for individuals and pensioners

To apply for a consumer, mortgage or other type of loan at Sberbank, so that employees do not refuse to issue, a potential borrower must submit a list of papers:

Certificate of a citizen of the Russian Federation (passport);

an application that meets the standards of the bank;

certificate on the form of personal income tax 2 or other document confirming income.

Citizens filling out an application without a permanent residence permit (registration) at the place of lending must submit a document confirming the actual place of stay. There are special programs and offers for retirees.

It is important to know that lending may be refused if: the borrower has no income; income is too low; suspiciously high income (the main answer to the question why they refused). These are not the only reasons for refusal, the bank responsibly approaches the choice of its clientele and therefore may refuse for any reason, but not without reason. However, they do not seek to voice them.

Mortgage loan in Sberbank

To arrange a mortgage lending, the borrower needs to agree to the commission of the future purchase by the bank representatives (they will assess the liquidity). So that the bank does not refuse to issue a loan, select objects in good condition... This applies not only to the apartment itself, but also to the foundation, area and other nuances. From the documents, you need to add documents to the object itself and a certificate of family composition. Provided for maternity capital preferential terms: use of funds for the first installment and reduced interest.

Consumer loan at Sberbank

Conditions to take a consumer loan:

Loan term up to 5 years;

interest from 15% (the bank offers the most loyal conditions (rate reduction) for holders of payroll or credit cards);

up to 1.5 million national currency;

no commissions, guarantors and collateral.

Cash loan

You can take a cash loan without certificates and guarantors at Sberbank in 2017 (standard consumer loan without collateral only with a passport). However, if you are not a client of the bank (for example, a holder of a salary card) and do not want to be denied a loan, it is still recommended to provide confirmation of your fin. provisions.

How to get a loan from Sberbank so that they don't refuse if you have a bad credit history - recommendations

WITH bad story the bank is unlikely to approve a large loan application. But getting a small consumer loan is quite possible. Another opportunity for employees not to refuse loans is a stable income, a permanent place of employment and / or registration on the security of real estate.

Can I get a loan from Sberbank if you are not working?

Non-working citizens can only count on a small consumer loan without collateral. However, the interest rate and conditions are quite strict and not everyone manages to take it in such a way that they do not refuse. Most reliable way take a loan - guarantors and better among the bank's clients.

How to get a loan for a pensioner at Sberbank at a low interest rate

Pensioners can apply for a bank loan only by using the special. suggestions. The rest of the conditions for the possibility of lending to this category of citizens can be resolved only on an individual basis (for example, guarantors can help).

How to pay a loan through Sberbank online

Registration and login to Sberbank Mobile Bank to pay off the loan

To register, the user will need to fill out an application (it is possible when applying for a loan) to receive a password. Then, through the ATM, receive one-time passwords (valid for one day) and complete the registration. After these procedures, the user will receive a login and password (the password can be changed later). The loan is paid according to the following algorithm:

Login to your personal account;

transition to the "payments and transfers" form;

entering details;

data verification and the "pay" button.

The payment arrives in a few seconds, which will be notified to the phone by SMS.