Evaluation of the apartment for what. All about the procedure for assessing real estate objects to provide a mortgage loan

Welcome! Today you will learn what an assessment of the apartment for a mortgage, why is it needed, how much is the assessment of the apartment for a mortgage and where to order it. In this post we collected information from our experts on this an important issue And ready to answer the remaining questions in the comments.

An integral part of the decoration mortgage contract is an estimate of the cost of the apartment. This is the requirement of the federal. Bank, issuing a loan in pretty big amount, requires a deposit at cost equal or exceeding the loan amount. In the case of the conclusion of a lending agreement for buying real estate, the subject of pledged is the purchased apartment. In this regard, and real estate is evaluated for mortgage lending.

The bank determines the amount of the loan amount, based on the liquid and market value of housing. Moreover, the smallest specified price is taken into account. Thus, the financial organization will prove itself in the case of gross violations of the lending contract by the borrower, thereby having the opportunity to sell property in a pledge, at the price that compensates all losses on the loan.

Also an assessment of real estate objects for mortgage lending is important for the borrower itself. First, it will help him assess the adequacy of the housing price that the seller installed. Secondly, the borrower can be sure that in the absence of the possibility of further timely repayment of payments, the mortgage agreement may be closed, through the sale of an apartment at a real market value.

On the one hand, in the interests of the bank, so that the cost of housing is artificially overestimated, otherwise, the cost of the mortgage agreement will not cover the property of the deposit. On the other hand, the borrower, and especially his realtor, are interested in a greater amount of loan and a greater amount of the transaction, respectively. Therefore, to comply with the interests of all parties, it is necessary to obtain an independent expert assessment.

How does an apartment estimate for mortgage

First of all, it is necessary to consider that the assessment of the apartment is produced when the housing is chosen finally and there is an agreement with the seller. In order for the real estate assessment for the mortgage, the borrower must collect the necessary package of documents.

It includes:

- Show-expanding documents. Most often this is a copy of the certificate of ownership of the apartment, or a copy of the contract of sale. If the mortgage is drawn up onto a part of the housing, then a copy of the contract of equity participation is provided.

- BTI plans, including apart exploration - a document that has a detailed description of the entire area, indicating exact sizes and a package. According to the schemes, the appraiser is asked for the identity of the actual and documented real estate plan. If a housing redevelopment is discovered during reconnaissance, then it will be necessary to register obligatory. Otherwise, the Bank will refuse to issue a loan.

- Copy of the cadastral passport. This document is issued in the BTI property owner of the real estate.

- Help that the house does not appear in plans for demolition (no need for new building).

- If the mortgage is drawn up on the living space in the house of the construction of the construction until 1960, there will be a certificate of overlappings. The fact is that old houses have overlaps from wood that are subject to greater fire hazard. Because of this, insurance companies refuse to cooperate the Bank, fearing the increased risks in the offensive insurance case. In this connection, the mortgage cannot be framed, since there is no insurance contract.

- Copy of your passport and contact details.

When all required documents They will be collected, the borrower must contact an assessment company and agree on the place and time of the examination. On the appointed day, the appraiser leaves for an object, where it conducts a certain sequence of actions, the result of which the report becomes - an assessment of the mortgage object.

Methods Evaluation

By studying expertise, the appraiser can use several methods in its work to determine the liquid and market value of housing. The most common method is comparative. In this case, the object is estimated from the point of view of closed transactions in the market of such housing.

True, evaluation judgments are taken into account, taking into account the determination of correction coefficients. They are calculated based on the difference of various essential housing indicators: novelty of the house, living space size, finishing quality, remoteness of construction from significant objects of urban infrastructure, etc. This method is also called market.

The second most popular method that the appraiser uses in its work is costly. AT this case Calculation of expenses to build an identical object.

The third, least applicable method (when the reason for the assessment of the apartment - Mortgage) is profitable. In this case, it is assumed what kind of potential income would bring an object of real estate if, for example, used for removal or with other appointments, the purpose of which is revenue.

When using the comparative method, the market value of housing is determined, and with a cost - liquid. Typically, a market and liquid price is not significantly different, but there are cases when the difference is noticeable. For example, the apartment has been made very expensive repairs from high-quality building materials, but at the same time the house in which it is located, refers to the old Fund and is located in the city distant from the center. In this case, the market value will be much exceeded by liquid.

Lucky on the inspection of the object, the appraiser not only examines the housing and makes reconciliation with the plans of BTI, but also takes pictures of the room.

The following factors are also required:

- prestige and environmental friendliness of the area;

- the presence of nearby stops, schools, children. gardens, clinic, shopping centers and other infrastructure;

- novelty of the house, condition of decoration, entrances, overlap;

- what materials built the building;

- number of floors in the house;

- establishment and frosting of the yard.

Regarding the apartment itself takes into account the following:

- square;

- number of rooms and their location (layout);

- state of finishes and communications;

- floor;

- the absence or presence of visible and hidden defects or breakdowns.

Ready report

Based on the above data, the appraiser is a report that contains the following information:

- First of all, the data appraiser and customer data are indicated.

- This is followed by data on whether the methods have been evaluated.

- It provides complete information about the estimated apartment.

- Comparative analysis of the real estate market.

- Liquid and market value of housing.

- Application.

Bank's credit specialists will primarily studied the final part that the report contains. It is in the appendix that the property and photos of the property will be duplicated, to duplicate information about the price of housing, and most importantly, the data on how much the bank can rescue from the sale of an apartment, in the event of a mortgage agreement.

The report itself is a printed document, a volume of 25-30 sheets of A4 format, laid, numbered and certified by the seal and the signature of the responsible employee of the appraiser.

The validity period of the evaluation report is 6 months. After this period, if for some reason the mortgage agreement has not yet been concluded, the Bank will ask the new, current document.

The term of preparation of the report on average ranges from 2 to 5 business days.

How much is

The cost of assessing an apartment for a mortgage will depend primarily from the region in which the assessment will be made.

In Moscow, for the assessment and reporting will have to pay from 3500 to 5,000 rubles. In St. Petersburg, order services appraiser will cost 3000-4000 rubles.

If the mortgage is issued in the regions, then the service pays an average of 2000-3000 rubles.

To save on the services of appraisers, first of all take care of timely feed Applications for evaluation. For urgent production report, the company will require an additional fee of 2-3 thousand rubles.

By choosing someone to order an assessment, learn the offers of firms and choose the fancy. Nevertheless, pay attention to the work experience of the organization and its reputation. After all, the report prepared by one-day company may be simply not accepted by the bank, since it will not be fulfilled in accordance with all the necessary requirements.

Who pays an estimate of the apartment? The one who acquires an apartment and order the service is a borrower. Who is issued a loan, he is interested in collecting all documents, which means that pays for the assessment.

Where to order an estimate of the apartment for a mortgage

Who makes real estate assessment? This is usually this or a company engaged in this type of activity or a private appraiser. Nevertheless, the following requirements are presented to all persons (physical and legal), which are evaluating real estate objects:

- The appraiser's activities should be insured for a period of 1 year.

- A company or private person should consist of SRO (combining self-regulating organizations), as well as on an ongoing basis to make contributions to the General Fund.

- The appraiser must have a policy of civil liability in the amount of 300,000 rubles.

These are the main rules. But there is another one that may affect the independence of the result - a company representative or a private appraiser should not be a relative of the person who orders the assessment service.

As a rule, when making a mortgage, a borrower does not have difficulty finding an appraiser. Typically, the Bank provides its client with a list of accredited organizations that can order this service.

Why better choose an appraiser from the list provided by the Bank? Because, all companies from this list are permanent partners of the financial organization, have proven themselves in this market, and prepare documents in accordance with all the requirements of the Association of Russian Banks and the Mortgage Housing Association.

Order a report in a proven company that the Bank trusts is to receive a document in as soon as possibleCompleted in all requirements. Why risk, and refer to a non-accredited bank firms, which will be able to less money for their work, but the final document will not be checked against credit specialists, and the real estate assessment will have to be ordered, with unforeseen, unnecessary expenses no one except the borrower will pay.

Choosing an appraiser from the list received at the Bank Pay attention to how long the company has existed on the market, whether it has managed to establish themselves, read the reviews on the Internet.

By choosing, you need to refer to the appraiser and apply. After that, you can start collecting the necessary documents.

What to do if the estimated value of the apartment differs from the sum of the mortgage loan

Based on the cost to which the apartment will be appreciated, the Bank will determine the size of the loan issued. If the estimated value is equal to or slightly exceeds the price established by the seller, the mortgage loan will cover all the costs of acquiring new housing. But there are often cases when the estimated cost is lower than the amount that is necessary for buying an apartment and, accordingly, the Bank cannot provide a loan for the amount of the above-mentioned in the evaluation company's report. What to do in this case?

First of all, you can order a re-evaluation of another specialist at your own expense. It is possible that during the primary assessment, all factors affecting the right pricing were not taken into account.

If, during re-evaluation, the price is determined within the same limits, it is possible to provide an additional deposit on the mortgage to the missing amount.

Also, you should not neglect the opportunity to ask the seller's discount. Perhaps seeing a real buyer, he will make concessions.

If there is no additional real estate, and the seller does not agree to lower the price significantly, it is possible to make a cash loan for the missing amount. True, the interest rate will significantly exceed the mortgage rate.

Conclusion

No mortgage deal do without assessing the apartment. This is not just a formality that requires additional expenses. A competent assessment makes confirmation that in the event of situations leading to the termination of the mortgage agreement, housing can really be sold by one of the parties to the parties, thereby covering all losses. The main thing for the bank, and for the client, so that the assessment was objective, professional and independent.

If you have any questions about this, we are waiting for them in the comments.

You will also be interested and important to learn how to make it right and why it is needed.

We will be applied for the repost, like and evaluation of the article.

Evaluation of the apartment for the mortgage is a mandatory requirement, without the implementation of which the signing of the Agreement is impossible. It is the conclusion that the expert will be fundamental in determining the amount of the amount that the borrower will be issued.

What is the assessment of real estate in mortgage

Real estate assessment is necessary to determine the amount that the bank will be ready to issue a borrower as mortgage loan. For the Bank, a report on the assessment of the mortgage apartment is necessary to determine the amount of the amount that he can recover in the event of the adoption of the debt and the need to sell pledged property. Since the price for secondary housing can vary very strongly (many factors are influenced for the final cost: since the need to make a loose repair and ending with the location of the apartment), then the appraiser's conclusion will determine which amount is necessary for the acquisition of this property and what should be the amount of the loan.

Based on the expert withdrawal, the Bank decides on the amount of mortgage issued.

Sometimes potential borrowers have a question, why do you need an estimate of the apartment in a new building with a mortgage, because the cost of the apartment determines the developer. Evaluation new apartment It is conducted after registration of property rights to the object, for the design of the mortgage. The need to provide at this stage of the report of the appraiser Bank, as a rule, prescribes as one of the responsibilities of the borrower in the loan agreement.

Where to order an estimate of the apartment for a mortgage?

The requirement to evaluate the apartment is provided for by paragraph 1 of Art. 9 of the Federal Law "On Mortgage (Property". This norm provides that the subject of mortgage must be registered in the contract (i.e., the property), its value, the term of the loan and the total amount should be registered. Also in the contract may be registered as debt collection.

The borrower himself can choose the appraiser, but usually the bank has its own list of specialists to whom it can recommend contacting. Insist on a specific appraiser, the banking organization has no right, but the appeal to the approved financial organization will speed up the process of consideration of the mortgage application, since the Bank does not have to check the qualifications of an unknown specialist.

To prohibit or indicate, to which specialist to contact, the bank has no right. If the borrower categorically does not want to contact the company specified by the Bank, and the banking organization refuses to bring the conclusion of another expert, the borrower needs to demand a written refusal indicating reasonable reasons.

An assessment of real estate objects with mortgage lending has the right to produce an accredited specialist who meets a number of requirements:

- is a representative of the registered organization of real estate appraisers;

- have a policy of civil liability in the amount of at least 300,000 rubles. This policy is a guarantee that in the case of an accidental or special error, third parties will not suffer during the assessment of real estate. In case of incorrect determination of the value of the object, the damage will be covered at the expense of this policy. The requirement of the presence of a policy of civil liability appraiser is regulated by Art. 24.7 of the Federal Law "On Appraisal Activities in Russian Federation».

Only accredited specialists can evaluate.

What documents are needed to assess the apartment for a mortgage?

To evaluate real estate for mortgage, you need to provide the following documents:

- show-expanding documents. Most often, this document is a sale agreement;

- technical passport from BTI.

All documents provided assures the customer with his signature.

How much is the real estate assessment for the mortgage?

On average, the price of assessment of the apartment for a mortgage ranges from 2000-3000 rubles. In Moscow and St. Petersburg, the price of expert services is somewhat higher and is about 4,000-5,000 rubles. Against the background of the cost of the apartment, these spending are not too large.

The cost of the service depends not only on the skill level of a specialist, but also from some other factors:

- location of an apartment. It's one thing if the apartment is located in the city, and completely different if the appraiser needs to go to some kind of distant village;

- urgency. The faster the borrower needs to get an expert's output, the more expensive the cost of the service will be.

How much is the assessment of the apartment for a mortgage in Sberbank? On average, the cost of the service is 3000-3500 rubles.

Speaking about who pays for an assessment of an apartment with a mortgage, then all spending lie on the borrower.

How is the estimate of the apartment for a mortgage?

The procedure for estimating the market value of the apartment for a mortgage does not differ from the estimation of real estate to implement the usual sale transaction. The client must conclude an expert agreement. After that, the date is determined when the specialist must come and inspect the sale object. In mandatory, the appraiser personally makes similar photos of the apartment, which subsequently applies to the report.

There are several ways to independent real estate assessment for the mortgage:

- market (comparative) - a comparison of already committed transactions with similar real estate objects;

- profitable - assessment of the prospects of this facility in the future from the point of view of income generation;

- cost - estimation of costs that will be required to build a similar object.

In addition to the apartment itself, the appraiser studies the following factors that ultimately influence the final value:

- year of building a building, whether his overhaulwhich condition is the communication;

- how far is the public transport stop;

- availability of social infrastructure;

- safety district.

If the area is new, then the prospect of its development is evaluated.

After studying and analyzing all factors, the expert prepares the final detailed report with reasonable decision. Usually the report takes about 25-30 pages. It indicates two prices that may differ: market and liquid.

The estimated cost is influenced by many factors.

What is a market and liquid value?

Market value is the price on which housing can be sold in as usual mode. The liquid cost is the cost for which the seller can urgently realize real estate in the event of a forced sale. As a rule, the liquid cost is about 80% of the market price.

Banks pay attention to the liquid value, that is, the price for which they will be able to implement the laid property.

The smaller the liquid value, the smaller size Mortgage loan will issue a bank.

How much is the assessment of the apartment for a mortgage?

According to Federal law "On appraisal activities in the Russian Federation" The term of the report - half a year from the moment is drawn up.

At the same time, the date of the assessment and the date of the compilation of the report differ in each other. As a rule, it is a few days, but sometimes the difference between the date of the actual inspection of the object and the date of signing of the expert output may differ for one or two weeks.

The expiration date of the expert is six months.

Evaluation of the apartment with impassable redevelopment for mortgage

On the this moment More than half of the apartments presented in the real estate market have certain changes. Under the redevelopment law, even change in the shape of doorways or a refusal of storage room in the corridor or bedroom is considered.

From the point of view of the bank, all the disappointed changes are disadvantages that negatively affect the cost of the apartment. Accordingly, the liquid cost of the apartment decreases, and the borrower can count on a smaller amount of mortgage loan.

Each case with redevelopment is considered separately. Difficult or almost impossible to legalize next species Redevelopment:

- dismantling of all partitions inside the apartment;

- demolition or partial dismantling of bearing walls;

- installation of the "Warm floor" system with powered from general centralized heating;

- accommodation kitchen, bath or toilet over residential residentials;

- dismantling the wall between the room and the balcony with the installation of the heating radiator with power from the centralized system;

- dismantling of ventilation systems or the closure of fire-fighting hatches in case of their presence.

Sometimes customers are asked not to indicate the result of redevelopment in the expert report. Hiding such information is fraught for the expert himself by deprivation of accreditation in the bank, and for the borrower - the Bank's demand ahead of money. In the worst case, the Bank may submit a claim with the requirement to compensate the entire damage caused to him. Given the seriousness of the consequences, conscientious appraisers never go to such a serious violation.

The disappointed redevelopment may be a serious interference when making a mortgage.

RESULTS

So, the assessment of the apartment is necessary to get a mortgage loan. The choice of a specialist, the conclusion of the contract with him and the payment of its services fully lies with the borrower, but the bank can recommend contacting a particular company.

Perhaps someone is not aware that the assessment of the mortgage apartment is made not only when the borrower to receive this mortgage itself as financial guarantees offers the bank on the security of some real estate already available. For what else need this procedure?

For the bank, the cost of an apartment / home is also of fundamental importance and when buying this particular housing on credit by its client. It is understandable, because the financial institution in the event of the fact of malicious non-payment of the mortgage will be the first thing to take a mortgage real estate at the borrower. In addition, in most situations, when issuing a housing loan, an approximate loan amount is first stipulated.

And then on the primary (currently almost always on the primary) market, a suitable living space is selected. And the bank requires an independent assessment of this dwelling and a strict report, which is thoroughly determining the market and liquid cost of an apartment or a private house. Only after the organization will issue a concrete amount of money to the client.

By the way, now in some banks the design of non-cash transactions is practiced. When the borrower does not even receive cash in hand, and the bank himself, as a trade intermediary, pays primary owner (developer, construction firm). And then the client will gradually return with interest to the bank they spent money. The need for an appraisal procedure is legally spent in the Federal Law "On Mortgage (Pledge of Real Estate)" - paragraph 1, article 9 (dated May 7, 2013).

What you need to know about the appraiser

The choice of the appraiser itself and the payment of its services is the task of an exclusively borrower. Although no one limits the client in the selection, but it is recommended that a company engaged in value analysis of real estate was accredited by a bank in which the client intends to take a mortgage. Since each bank may have their own individual requirements for evaluation reports. In addition, any such report must comply with the requirements of the Association of Russian Banks (ARB) and the Mortgage Housing Association (AHML).

That all these items are probably observed, the company chosen by the borrower should have confirmation of membership in SRO (self-regulatory organizations in the real estate market) and a policy of civil liability insurance minimum amount 300 thousand rubles. The insurance policy of the appraisal company indicates that the organization is not relevant to the organization.

Plus this is a guarantee that in the event of a specialist error or error, the money to the customer will be returned in whole or in part (depending on the rudeness of the error made in the report). If an independent company is not accredited by the bank, then all these details of the borrower will have to attach to the report. An assessment of a mortgage apartment is usually ordered after the first preliminary interview with the creditor bank was held. To approximately know which accommodation itself should be evaluated.

So that it did not succeed in such a way that the customer paid for the analysis of the apartment worth 2.2 million rubles, and the bank later agreed to give a mortgage only in the amount, say, 1.5 million rubles. Price list of valuation organizations varies depending on the city and circumstances. Minimum - 2,000 rubles per report. But this amount can grow to 6,000 rubles.

Required documents

It is necessary to order an estimate first of all when it is necessary only when the borrower is going to lay the bank already existing real estate. So, things such as the approximate cost of the service of the assessment and the period of it can be stated with specialists and by phone. By phone, you can leave a preliminary application for the conclusion of an assessment agreement. With a full-time meeting, the client must provide the selected organization a set of documents. There will be a photocopy in these circumstances, but they must be certified by the notary.

- Passport and customer contact details.

- Cadastral and technical passports of the estimated real estate (issued in BTI).

- Desirable scheme of an apartment plan and \\ or at home.

- For buildings built until 1970, an additional certificate is required, the guarantee that the structure will not be demolished or reconstructed.

- A document that substantiates the need for an assessment: confirmation of ownership of housing, extract from the bank about the possible issuance of mortgages, evidence of equity participation, etc.

Since this article implies exactly the assessment of the apartment for a mortgage, then later this type of residential real estate will be subsequently. Since apartments are the most common option of living space in the Russian Federation, then the assessment firms have already "hand-made" relative to their value analysis. Almost always the inspection procedure of the apartment takes no more couple hours.

Two types of apartment costs than they differ and what is important to the borrower

At the pre-agreed time, the appraiser travels to the address. The specialist conducts a comprehensive visual inspection of the apartment, photographs all the premises, studies the house and the surrounding area. It is important to mention why real estate assessment for mortgage consists of two levels. The fact is that real estate has a liquid and market value. The liquid value is determined when using the cost approach. That is, the appraiser finds out how much money will be needed to build a similar object.

Comparative (analog) and profitable approaches are added here as a supplement. A comparative approach means monitoring of all similar transactions in the real estate market to determine the average price. The income approach determines how studied real estate can rise in price in the market in the near future (from six months to 3 years). What is the liquid value for? It determines as if the objective value of housing.

Details of the market value

But the second level of evaluation finds out how much the seller can request for this living space. That is, it will be its market value. It may seem that the market value is a more subjective characteristic than the cost of liquid. But no. The primary owner is always forced to look at the overall situation in the real estate market.

If he will overestimate prices, then the clientele lears to other sellers with more favorable offers. Although here also has its own "pitfalls" - construction monopolies, price manipulations ... However, this is a completely different topic. The market price of housing defines many characteristics that all must be reflected in the appraiser report:

- Analysis of the infrastructure is how convenient the house with the estimated apartment is located from the nearest hospitals, schools, shopping centers, transport hubs, highways, etc. The planning of the courtyard area is taken into account.

- Analysis of the house - the year of commissioning and deadlines for construction, floors, construction type, main building materials (panel, brick, wood, other), technical and communication equipment (electricity, water supply, heating, gas supply, telephone, Internet, satellite television), availability / Lack of visible defects.

- Analysis of the apartment - the floor, general and living spaceThe number of rooms and the area of \u200b\u200beach, the condition of the windows, the presence / absence of balconies or loggias, quality planning, no illegal redevelopment, repair quality and general condition.

In general, liquid and market cost is rarely much different. Bright example A big difference between them is a first-class decorated apartment (high market value) in an old, two-story, wooden house (low liquid value). One way or another, but the bank always gives the mortgage, based on the cost, which is less. Moreover, not only the size of the loan, but also the loan period, and the interest rate will depend on the minimum digit. Thus, the institution reduces possible costs to a minimum. The borrower may have problems when the market value is seriously higher than liquid.

The bank will issue money in accordance with the results of the cost approach, and the apartment seller requests more. Then the borrower remains two options - look for additional finances (for example, to issue consumer credit) Either look for another, cheaper apartment. You can also demand repeated analysis housing.

In conclusion, it is worth warning that you should not try to negotiate with an appraiser about artificially overestimated prices. So that the bank issued more money. Banks have their own professionals who repeatedly recheck the report. Such rechecks are needed to identify unintended errors.

In general, the activities of assessment firms are monitored by the Federal Law "On Appraisal Activities in the Russian Federation" from 29.07.98 per number 135-ФЗ. For the mistakes allowed, the firm may incur before the client financial and administrative, and sometimes criminal liability. Real estate assessment for mortgage is conjugate with a turn of quite large monetary sumsTherefore, accuracy and guarantees are very important here.

Ready report

When everything is completed, the specialist draws up a written report (up to 30 pages) and makes a call to the customer so that the latter will go to the company's office for final reconciliation. Full, ready, written report must necessarily contain the following items (with a detailed description).

- general data of the estimated company and the data of the client itself (passport, contacts, details of the company, if the client is a legal entity);

- a complete list of all used assessment methods;

- package of real estate studied data;

- monitoring the real estate market at the moment with a short-term forecast for the future;

- determination of two types of housing cost;

- appendix. The most important for the bank is part. This includes: all the main property documentation, photos of the object made by the employee of the company, re-indicating the market value and the liquidation price. The last item informs the Bank on how much he can sell this housing in the event of termination of the mortgage agreement with the borrower.

The presented material is informational and applied, i.e. the article is intended to respond to the most common issues that arise when taking a mortgage loan and associated housing evaluation procedures.

Prehistory: A family has addressed us for the preparation of documents for the purchase of a Moscow apartment to the mortgage. The bank, for the approval of the mortgage on the apartment, requires its assessment from independent evaluator experts. The order and receipt of the evaluation report are included in our service preparation service, so we started looking for a suitable appraiser expert. In the process of search, we came across the service ocenkashop.ru.

This service was convenient because it is not necessary to search for the firms of appraisers, visit their sites, call them to find out the cost, deadlines and conditions for receiving an apartment evaluation report, etc. The service itself is free, you only need to pay an expert for preparing an assessment report.

Ocenkashop.ru works for this principle:

- You leave online application to assess the apartment in the service ocenkashop.ru ↓

- The service informs the evaluator experts on your application ↓

- The appraisers offer their price, deadline and place of issuing an assessment report ↓

- You are from the entire list of offers, depending on the price and conditions for obtaining an assessment, choose a suitable expert ↓

- Pay for an application and after readiness (2-5 business days) Receive an assessment report

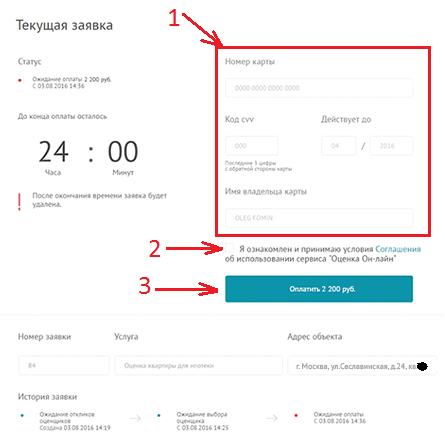

Here is a picture with ocenkashop.ru (to enlarge the pictures, click on it)

If you look at our orders in the service Ocenkashop.ru - average cost Estimates of the apartment in Moscow for Mortgage - 2000-3500r. There are 2 options for order - "Standard" and "urgent". "Urgent" order is more expensive at about 20-30% than "standard".

Middle time Preparation of the evaluation report from 2-5 working days. Up to 5 working days is with the "standard" order. Up to 3 working days with the "urgent" order. We had and the next day gave a report.

Each appraiser has accreditation In their banks. Here is a list of all banks that accept evaluation reports from experts registered in Ocenkashop.ru: Sberbank, VTB 24, Gazprombank, Rosselkhozbank, Bank of Moscow, Tatfondbank, Metalinvestbank, FC Opening, Deltacredit, Absolutbank, MTS Bank, TranscapitalBank (TKB Bank ), OTP Bank, Svyaz-Bank, Loko-Bank, KB Mia, Raiffeisenbank.

According to the creators, more than 30 appraisers are registered in the service ocenkashop.ruReady to accept and execute orders.

Instructions for the selection of expert, order and receipt of the evaluation report

For clarity, we will show an example of one of our report of the report, which we have done for some of our customers. The order was to assess the Moscow apartment for a mortgage in Sberbank. The apartment is located in Moscow, on Suslavinskaya House Street 24. The apartment's room will not show. Repeat for us:

- Go on service ocenkashop.ru.

- Select "Evaluation of a mortgage apartment".

(Click on pictures to enlarge them)

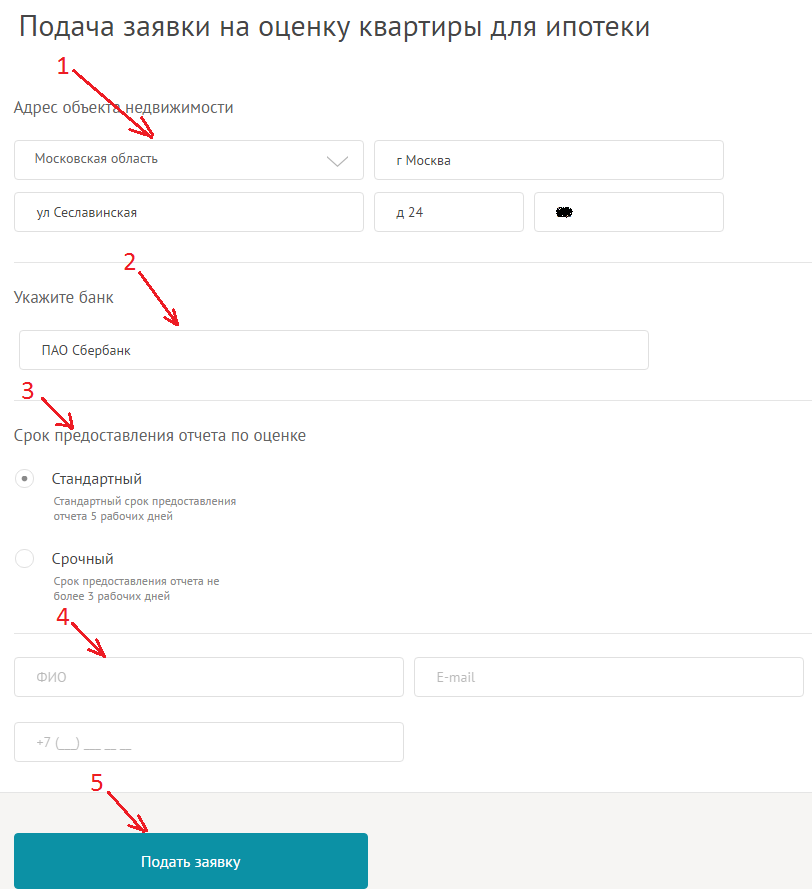

- Fill in the information and click on "Apply".

- Fill in the address: Region - Moscow region, city - Moscow, street name, house number and apartment room.

- Specify the bank.

- Select a deadline for the evaluation report. As it was written above, the "urgent" order is more expensive at about 20-30% than "standard".

- Fill in your contact details such as FULL NAME, E-mail address and phone number.

- Click on the "Apply" button.

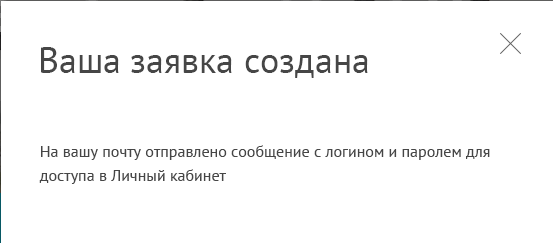

- Application filed.

- Activate your personal account.

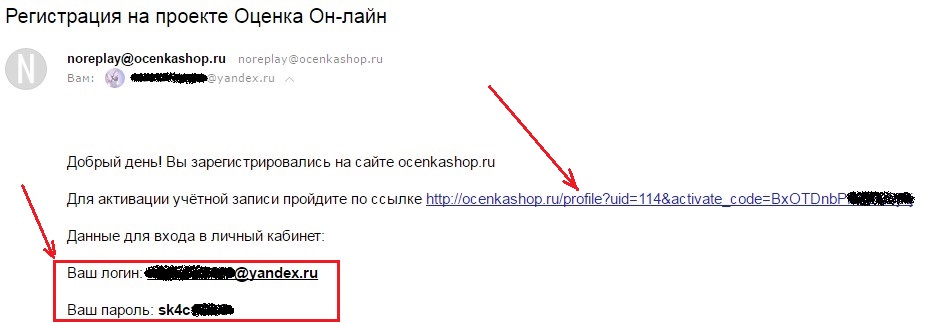

On the specified you email A letter comes from the postal address [Email Protected] With a reference to activate the cabinet, as well as with a login and password for the entrance. Follow this link.

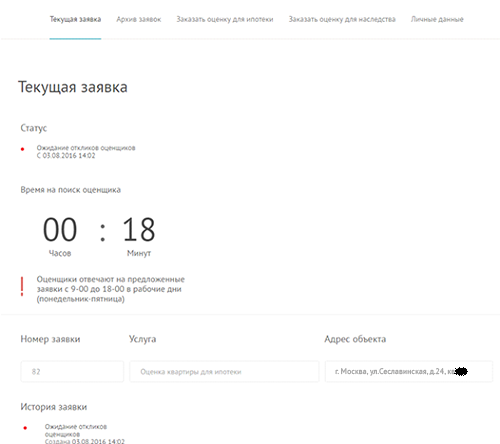

- After the transition opens a personal account. Wait for response on request from appraisers.

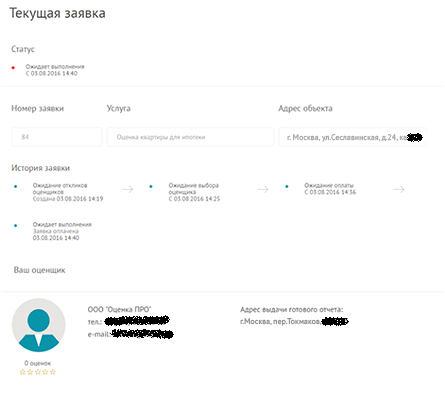

To see the status of the application, click on the "Current Application" tab.

Because Application "urgent", then wait for the response to 20 minutes (we left 18). If the application is "Standard", then wait no more than 1 hour. And it is important to understand that the response time depends on when an application was left. If the application was left in working time - from 9:00 to 19:00 Moscow time from Monday to Friday. Those, for example, if the application is left on Tuesday at 1:00, the appraisers will see it only in the morning at 9:00 and until 10:00 respond to the application (this is if with a "standard" order).

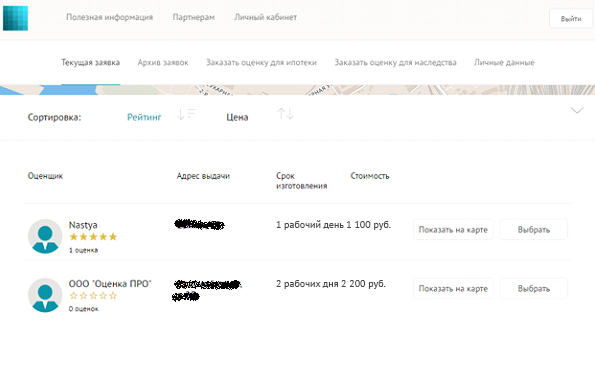

- Select an appraiser.

As soon as the time is over to the response, in the "Current Application" tab, appraisers will be listed that responded to your application. The table will list the name of the appraiser, the cost of manufacturing an assessment report, its production and address of its production.

Click on the "View on the map" button opposite each appraiser to see where you can pick up an assessment report.

Each appraiser accredited, so their reports will accurately accept your bank. To select a specific appraiser, in front of it, click on the "Select" button and confirm your choice.

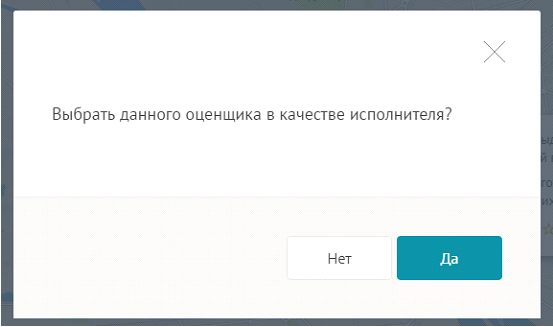

- Pay for the application.

After selecting a specific appraiser, a form for payment appears in the current application. You can pay the application by a map of any bank. The application will not go to work appraiser before payment!

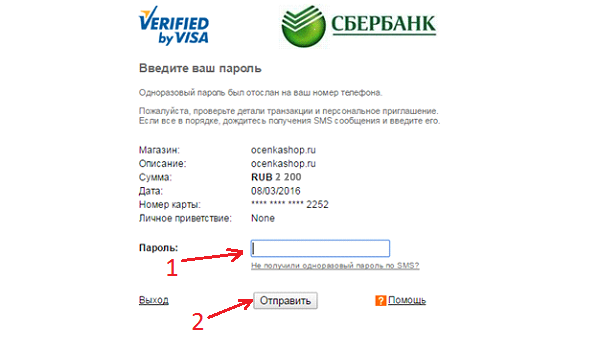

To pay, enter the bank card data (1), check the box (2) and click on "Pay".

After, in the window that opens, enter a disposable password. He will send it mobile phonewhich is tied to the bank card.

(We paid the Sberbank card, so we had an input window so)

- After successful payment the application enters the appraiser. Contacts of the appraiser are becoming visible. If necessary, a representative of the appraisal company will contact you, requests the necessary documents or agree with you about the meeting, where you are comfortable. You do not have to spend time traveling to the company's office.

- Take an apartment evaluation report.

After the appraiser fulfills the application and give the report to the hands, in personal Cabinet The "Report is given" will be displayed.

The client and I received a report on the hands within 2 days after payment of the application and meeting with the representative of the company. We remind you that our order was "urgent" and it is up to 3 working days. "Standard" order is performed up to 5 business days.

After receiving the report, you can raise an assessment for the work done in the appraiser card. If there are any questions, on the site ocenkashop.ru at the bottom there is a "Support Service" button.

Under the evaluation of residential real estate, the calculation of approximate market value is most often understood in comparison with the same objects in the area. As a rule, the housing evaluation service is resorted when making a mortgage: an assessment report is one of the mandatory documents in the list. Sometimes it is resorted to the estimate in the case of a direct transaction, when the buyer does not trust the seller and considers the declared price of the apartment or the house overestimated.

The process of making a mortgage loan for the purchase of housing is not necessary without the preparation of a document on an independent expert assessment of the fair value of the facility. Evaluation of the apartment is mandatory procedurewhich defines approximate value Housing compared to similar objects, and also establishes a liquidation price in case of no return of credit funds.

Based on the evaluation report for the mortgage, the Bank makes a decision on the provision of a loan or refusing to consider this apartment, for example, in view of the unjectative price established by the Seller.

We estimate:

- Apartments

- Dacha

- Cottage

- Land plot

- Garage

- Residential building

Our company carries out a comprehensive analysis of the cost of housing, as well as land plots for mortgage. We work with private clients and legal entities. We have already compiled hundreds of expert opinions, and experts of Ay-Es Consulting are accredited in the leading banks of Russia (Sberbank, "Revival", "Deltacredit", etc.).

Benefits

Urgent estimate

It is logical that the owners of the apartments are asked for some time: "How to evaluate the cost of an apartment belonging to me"? And more often the assessment of the apartment becomes simply necessary in the case of the sale, purchase, housing exchange, or acquiring it to the mortgage.Delivery report

Want to resolve the issue with an assessment of an apartment or real estate without leaving home? No problem! Pay our services through the Internet Bank, and we will deliver a ready-made assessment report to your instructions!We work on weekends

You can contact us on weekends on the assessment of an apartment or real estate. For your convenience, we work 7 days a week.Operational inspection

To start preparing an apartment or real estate evaluation report, it is necessary to inspect the object. Usually we are ready to do this for the next day after contacting us.List of necessary documents

In order for the procedure for assessing the house for a mortgage apartment or another facility, it is quickly and without lining, we recommend pre-prepare a package of documents in advance. For different species real estate lists are slightly different

Primary market

- participation Agreement (Penackets, Replying Rights Requirements, Booking, Investing, Preliminary Sales Treaty)

- floor plan and explication, or project plan

- passport details of the borrower

Secondary market

- Certificate of ownership (extract from the USRR)

- Technical Passport Apartments (Floor Plan and Explication)

- Passport details of the borrower

- Certificate of ownership of the house and land

- Technical Passport Buildings

- Passport details of the borrower

- Certificate of ownership of land

- Cadastral Passport of the Land

- Passport details of the borrower

At what stage is the assessment?

As soon as the object is selected for the acquisition (new building or real estate in the secondary market), you must agree further actions with the bank. Ideally, you need to submit a copy of documents to an object for a preliminary assessment by a bank agent. If the financial institution specialists are arranged, it is possible to initiate evaluation events.